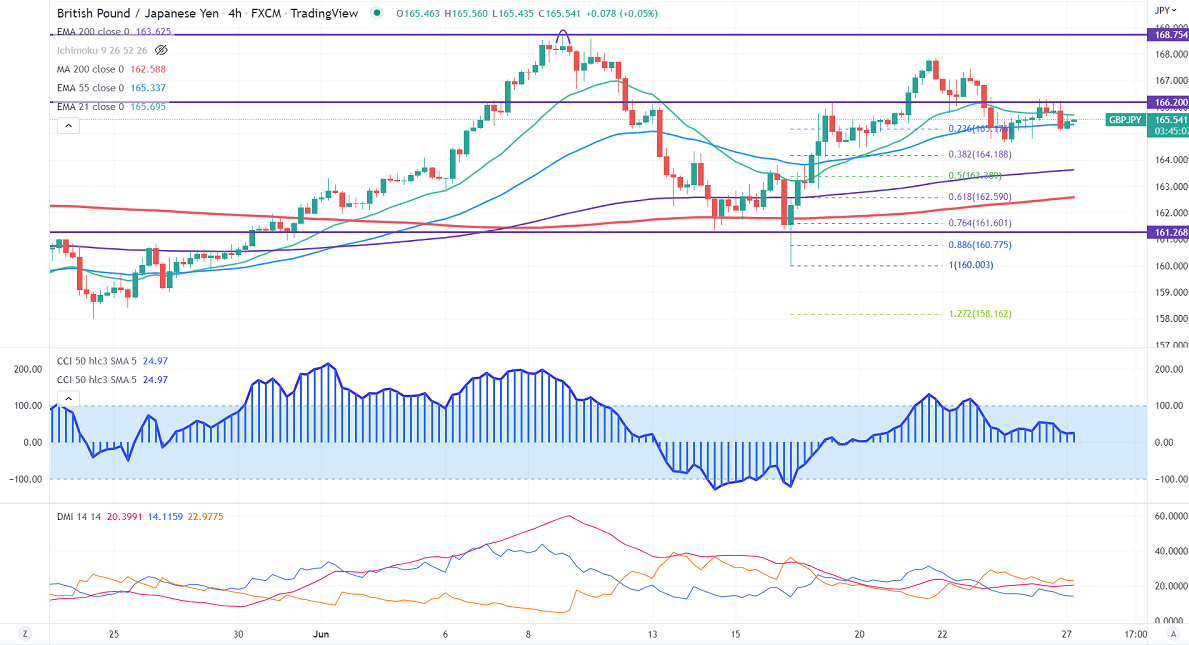

GBPJPY is trading flat after a minor sell-off the previous week. The pound sterling trades higher after upbeat UK CPI data. It hits a 40-year high at 9.1% in line with estimate, slightly higher than the previous month's 9%. Technically in the 4-hour chart, the pair is holding below 21-EMA, above 55 EMA, and long-term 200 EMA (163.60). Any break below 164.60 will drag the pair down to 163.67/162.65. GBPJPY hits an intraday high of 165.72 and is currently trading around 165.52.

The near-term resistance is around 166.30, any breach above targets 167/167.85/168.75.

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- Bearish

It is good to buy on dips around 165.50 with SL around 164.40 for TP of 168.