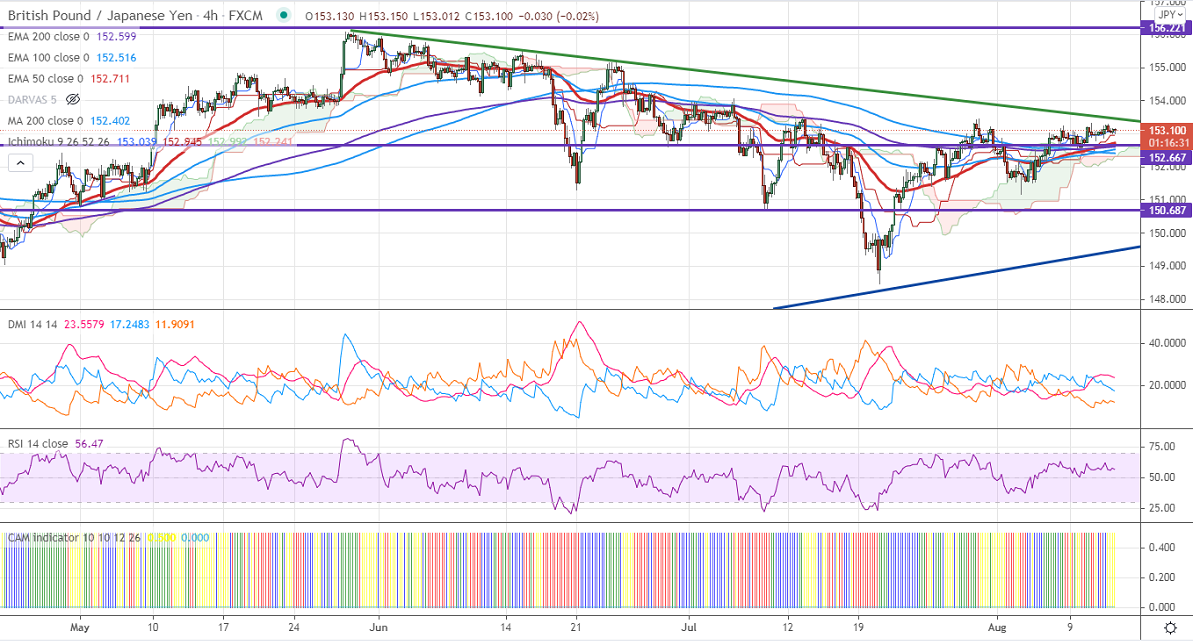

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 153.03

Kijun-Sen- 152.945

Previous week high – 153.45

GBPJPY is consolidating between 153.31 and 152.78 for the past two days. The minor pullback in Pound sterling above 1.3850 is supporting the pair. The UK economy has grown at 4.8% in the second quarter in line with estimate, after 1.6% contraction in Q1. USDJPY retreats from a high of 110.80 as safe-haven demand increased on the concern of delta variant. The intraday trend of GBPJPY is still bullish as long as support 152 holds.

Technical:

The pair's immediate resistance is around 153.50, any jump above targets 154/155.05/156. Significant bullish continuation if it breaks 156.60. On the lower side, near-term support is around 152.49. Any indicative violation below targets 152/151.54/151.

Ichimoku Analysis- The pair is trading above 4-hour Kijun-Sen and above Tenken-Sen.

Indicator (4-Hour chart)

CAM indicator-Neutral

Directional movement index –Bullish

It is good to buy on dips around 152.90-95 with SL around 150.70 for a TP of 153.50/154.