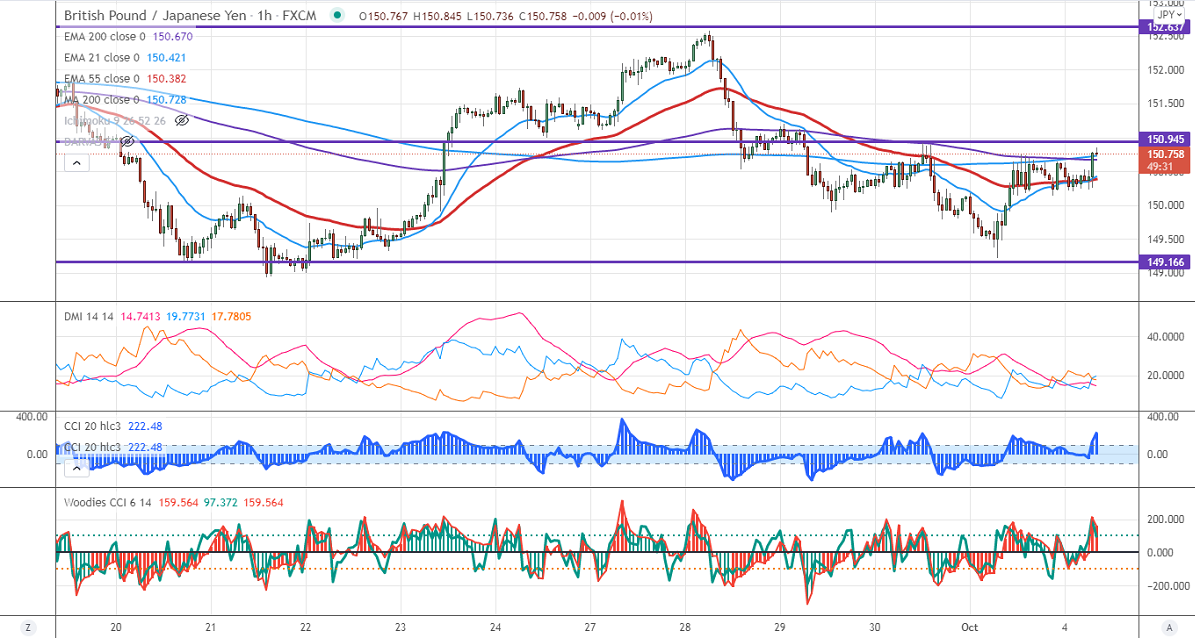

Major Intraday resistance -151

Intraday support- 150

GBPJPY is consolidating in a narrow range after a minor pullback from 149.22. The pound sterling has recovered sharply from YTD lows of 1.34125 against the US dollar. The sharp upside movement in global equity markets and decline in US treasury yield are putting pressure on the US dollar. GBPJPY hits an intraday high of 150.70 and is currently trading around 150.56.

USDJPY- Analysis

The pair has declined nearly 100 pips after hitting a multi-month high of 112.05. It should close below 110.80 for intraday bearishness.

CCI Analysis-

The CCI (50) and Woodies CCI are trading above zero lines in 60 min chart. But in Woodies CCI uptrend is not yet confirmed.

Technical:

The pair's immediate resistance is around 151, any surge above targets 151.30/151.80/152/152.60. Significant bullish continuation if it breaks 153.50. On the lower side, near-term support is around 150. Any indicative violation below targets 149/148.40/147.

Indicator (Hourly chart)

Directional movement index –Neutral

It is good to sell on rallies around 151 SL around 151.75 for a TP of 149.