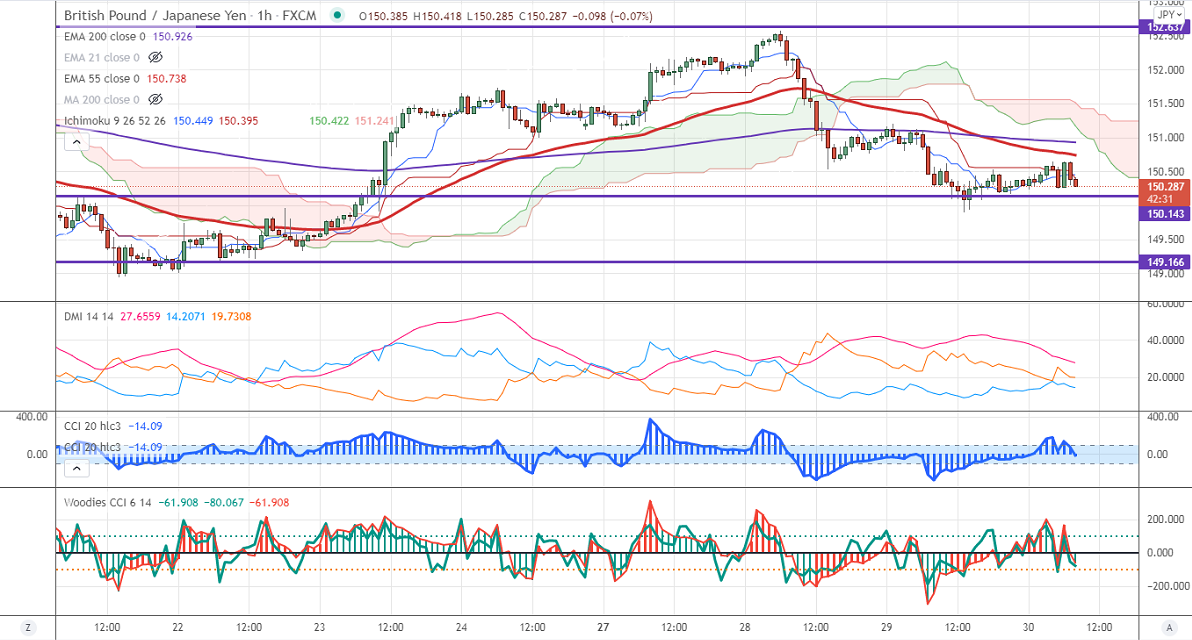

Major Intraday resistance -151

Intraday support- 150

GBPJPY was one of the worst performers in the past two days and lost more than 250 pips on the weak pound sterling. The pound sterling declined sharply against the US dollar and hits the lowest level since Jan 2021 on board-based US dollar buying. The increase in COVID cases and Brexit concerns is dragging the pair further down. GBPJPY hits an intraday low of 150.30 and is currently trading around 150.305. The intraday trend of GBPJPY is bearish as long as resistance 151 holds.

USDJPY- Analysis

The pair jumped and hits a multi-year high at 112.06. It should close above 112.25 for major bullishness.

CCI Analysis-

The CCI (50) and Woodies CCI are trading below zero lines in 60 min chart. So the trend for the intraday is bearish.

Technical:

The pair's immediate resistance is around 151, any surge above targets 151.30/151.80/152/152.60. Significant bullish continuation if it breaks 153.50. On the lower side, near-term support is around 150. Any indicative violation below targets 149/148.40/147.

Indicator (Hourly chart)

Directional movement index –bearish

It is good to sell on rallies around 150.65-70 SL around 151.30 for a TP of 149.