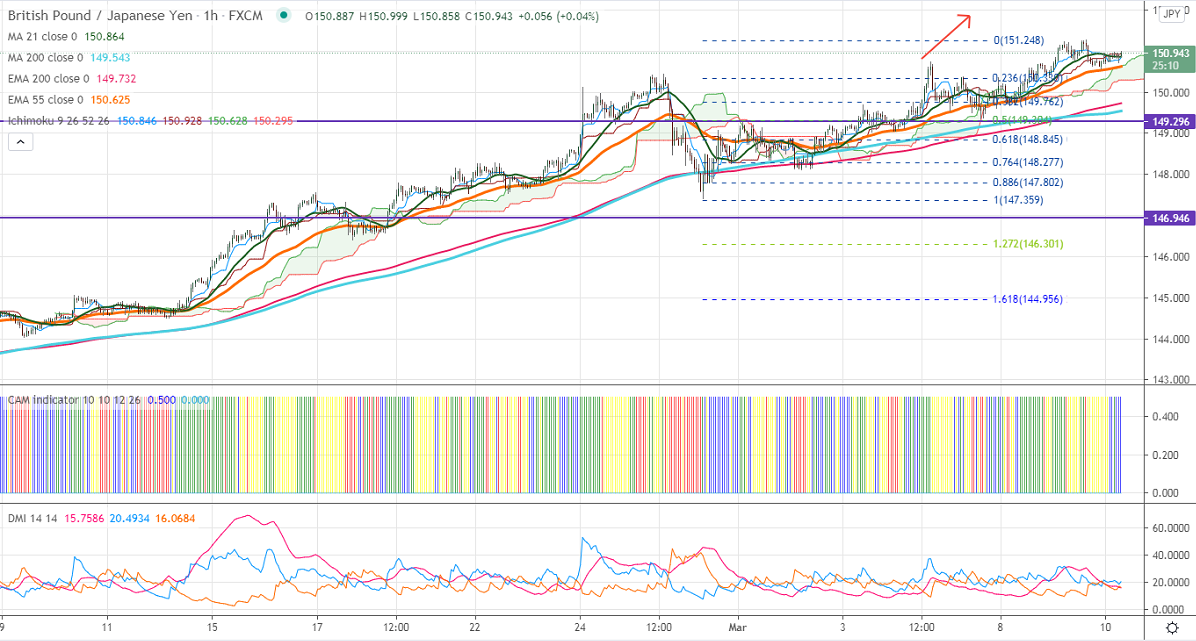

Ichimoku Analysis (Daily Chart)

Tenken-Sen- 149.34

Kijun-Sen- 147.06

GBPJPY is trading higher for the past nine days and holding well above 150 levels. The weakness in the yen due to a surge in US bond yield and upbeat market sentiment. USDJPY is struggling to close above 200-W MA; any close above 109.01 confirms significant trend continuation. GBPUSD declined for the fifth day in a row on broad-based US dollar buying is putting pressure on GBPJPY at higher levels. The short-term trend of GBPJPY is bullish as long as support 149.50 holds.

Technical:

The pair has closed well above 150 levels for the second consecutive days. This confirms significant bullishness, a jump to 152.70/154 likely. On the lower side, near-term support is around 150.50. An indicative break below will drag the pair down to 150/149.50. Significant trend reversal only below 147.40.

Indicator (Daily chart)

CAM indicator –Bullish

Directional movement index –Bullish

It is good to buy on dips around 149.50-55 with SL around 149 for the TP of 150.70.