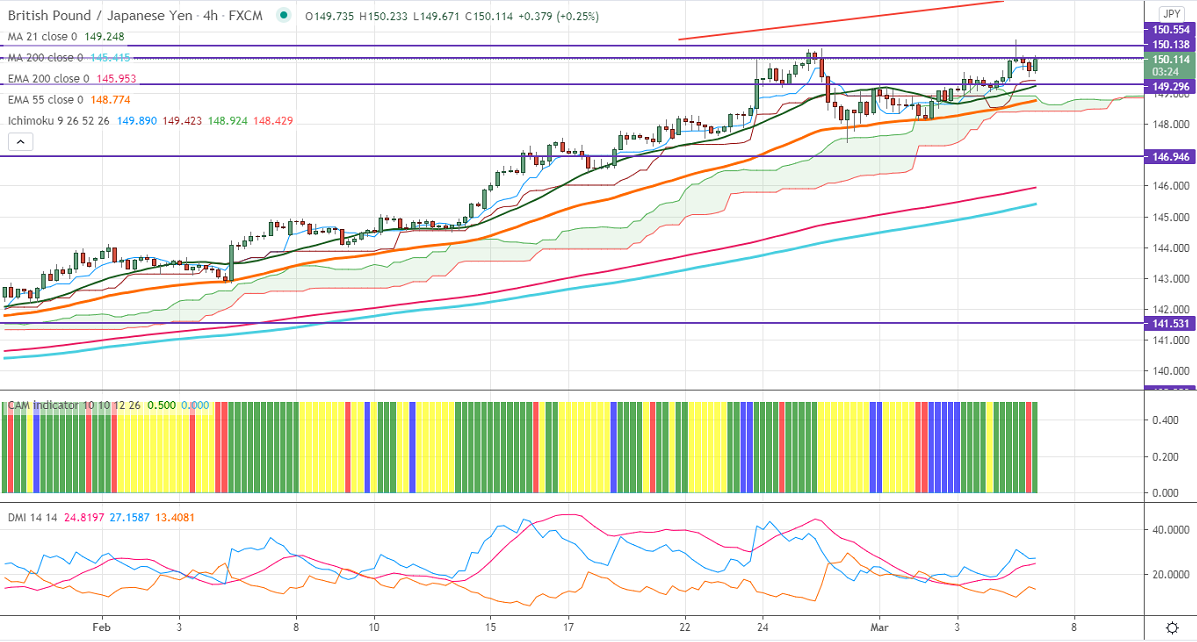

Ichimoku Analysis (Daily Chart)

Tenken-Sen- 148.86

Kijun-Sen- 146.31

GBPJPY recovered sharply above 150 and lost more than 100 pips on the weak Pound sterling. GBPUSD lost more than 150 pips on surging US bond yield. USDJPY is holding above 108 levels, a jump to 108.80 likely. The yen is inversely related to US bond yield. The short-term trend of GBPJPY is bullish as long as support 147.28 holds.

Technical:

The pair is holding above 150 level, any violation of 150.73 (yesterday's high) confirms bullish continuation. A jump to 151.22/152/152.90 likely. On the lower side, near-term support is around 149.50. An indicative break below will drag the pair down to 148.85/148.25/148/147.40. Significant trend reversal only below 144. A violation below will drag the pair to 142.80.

Indicator (4 Hour chart)

CAM indicator –Bullish

Directional movement index –Bullish

It is good to buy on dips around 149.50-55 with SL around 149 for the TP of 150.70.