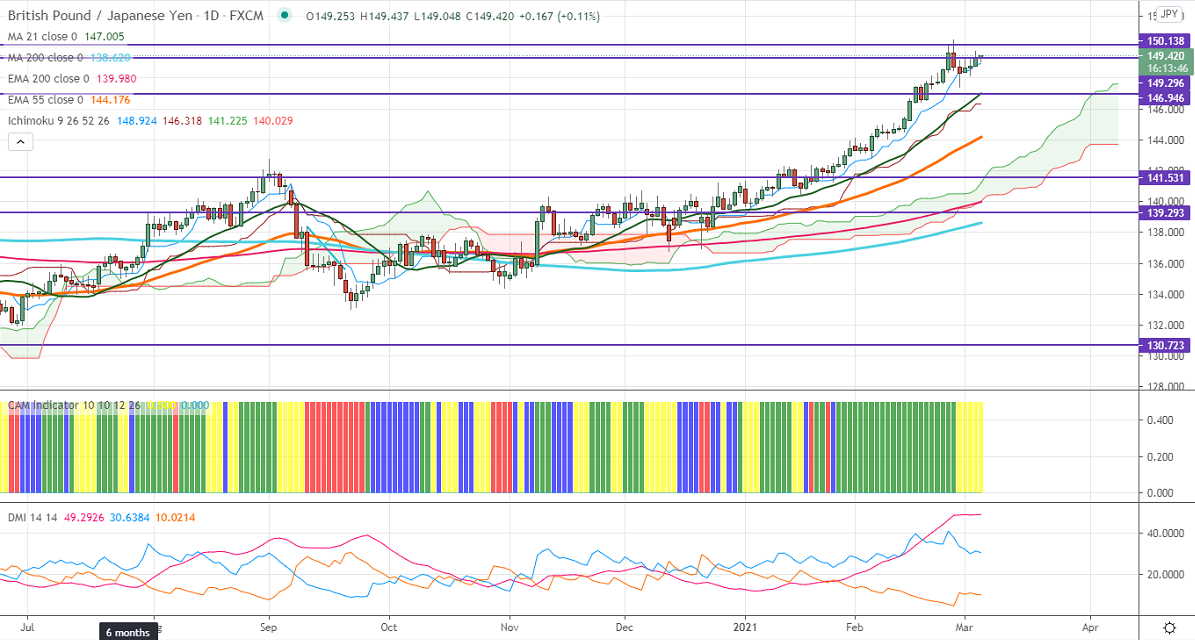

Ichimoku Analysis (Daily Chart)

Tenken-Sen- 148.86

Kijun-Sen- 146.31

GBPJPY recovered more than 200 pips from a low of 147.28 on weak Yen. The yen is trading against all majors on a surge in US bond yield. USDJPY is holding above 107 levels, a jump to 107.95 likely. GBPUSD is consolidating between 1.38589 and 1.40062 for the past two days. The UK Chancellor Rishi Sunak has extended the furlough scheme until Sep and plans to raise the tax in near future. The short-term trend of GBPJPY is bullish as long as support 147.28 holds.

Technical:

The pair is facing significant resistance at 149.70, a jump to 150.50 likely. Major bullish continuation only above 150.50. A jump 151.50/153. On the lower side, near-term support is around 148.70. An indicative break below will drag the pair down to 148.25/148/147.40. Significant trend reversal only below 144. A violation below will drag the pair to 142.80.

Indicator (Daily chart)

CAM indicator –Neutral

Directional movement index –Bullish

It is good to buy on dips around 148.75-80 with SL around 148 for the TP of 150.50.