GBPJPY trading in a narrow range between 182.67 and 184.38 for the past four days. It hit a high of 184.38 yesterday and is currently trading around 183.69.

GBPUSD- Trend- Bearish

The pound sterling recovered slightly after hitting a multi-month low. The dismal UK GDP has decreased the chance of a rate hike by the Bank of England. Any break below 1.2440 confirms further bearishness.

USDJPY- Bullish

The pair pared some of its despite upbeat US inflation data. The significant resistance is 148/150.

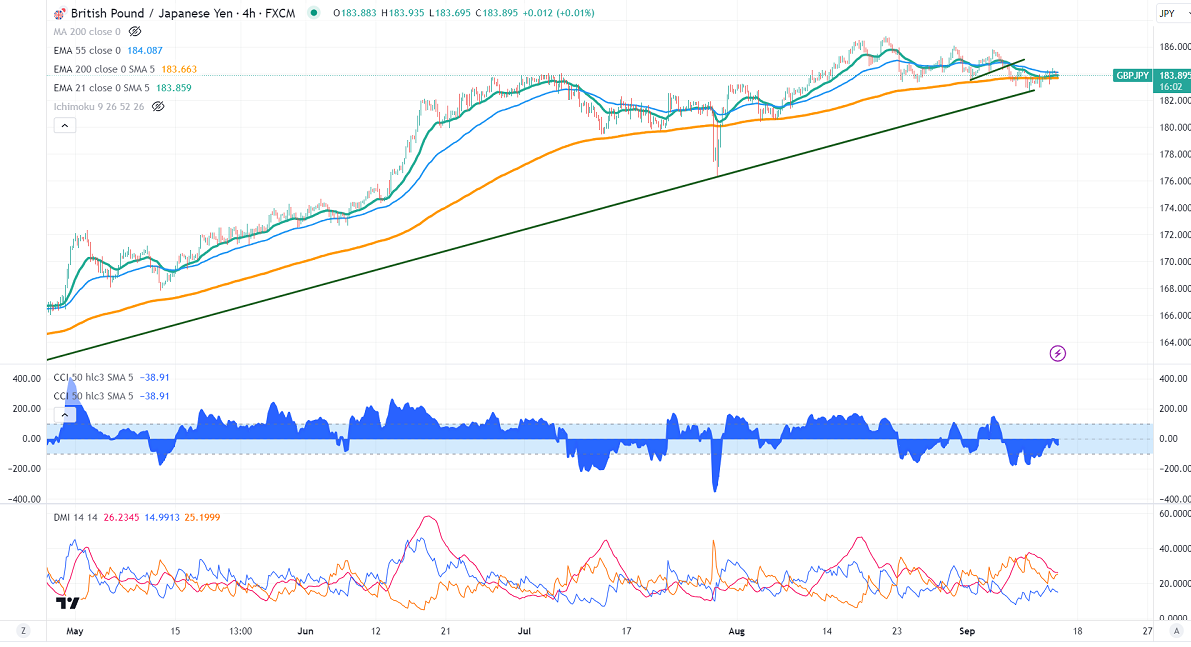

GBPJPY analysis-

The near-term resistance is around 184.25, a breach above targets 184.60/185. The immediate support is at 182.80, any violation below will drag the pair to 182/180.

Indicators (4-hour chart)

CCI (50)- Bearish

ADX- bearish

It is good to sell on rallies around 183.75-80 with SL around 185 for the TP of 180.