FxWirePro- GBPJPY Daily Outlook

GBPJPY lost its shine on the weak Pound sterling. It hit a low of 184.31 yesterday and is currently trading around 184.43.

GBPUSD- Trend- Bearish

The pound sterling trades below 1.25000 on board-based US dollar buying. US ISM services PMI rose to 54.50 in August, compared to a forecast of 52.50. The US dollar index gained momentum after US ISM services hit the strongest level since Feb. Any break below 1.2460 confirms further bearishness.

USDJPY- Bullish

The pair trades higher on a surge in US treasury yield. The significant resistance is 148/150.

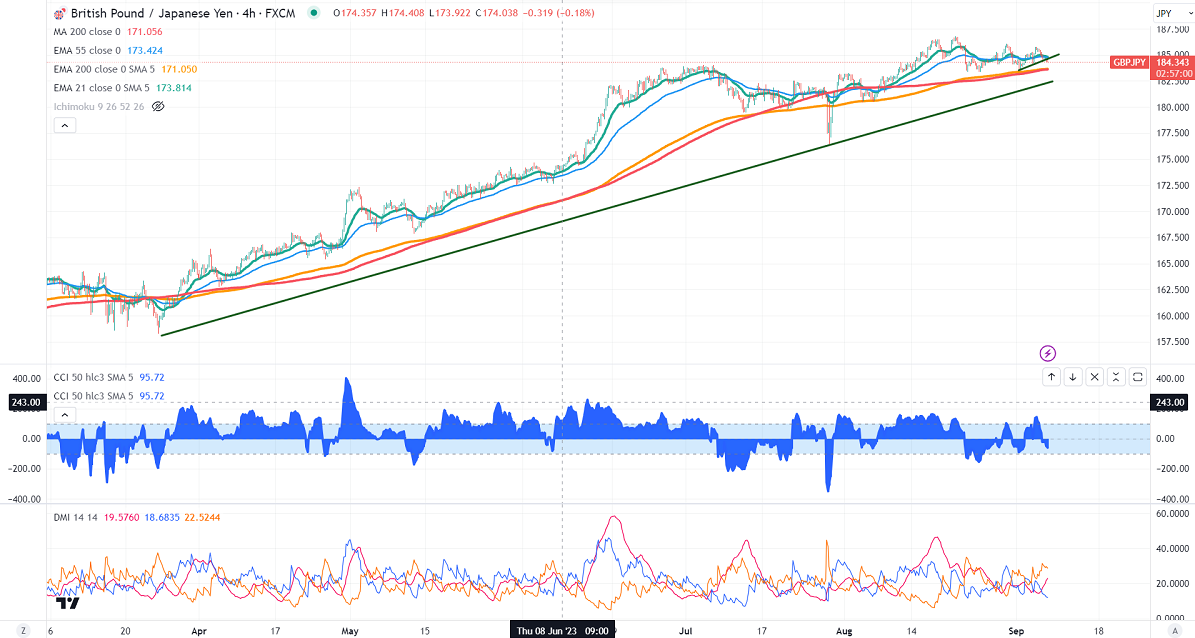

GBPJPY analysis-

The near-term resistance is around 185, a breach above targets 186/186.50/187/188.50. The immediate support is at 184, any violation below will drag the pair to 183/182

Indicators (4-hour chart)

CCI (50)- Bearish

ADX- neutral

It is good to buy on dips around 183.45-50 with SL around 183.35 for the TP of 186.65.