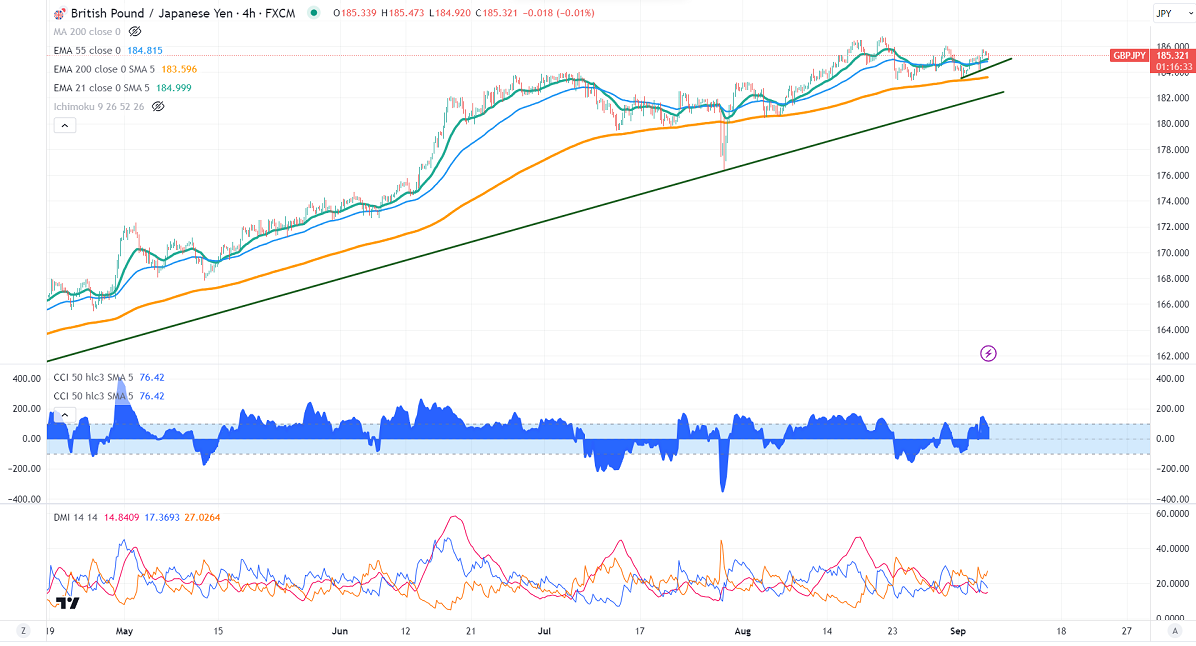

GBPJPY pared some of its gains made yesterday on the weak pound sterling. It hit a low of 184.92 at the time of writing and is currently trading around 185.138.

GBPUSD- Trend- Bearish

The pound sterling lost its shine on board-based US dollar buying. UK final services PMI came at 49.50 in August, compared to a forecast of 48.70. According to the British Retail Consortium, UK retail sales rose 4.1% on an annual basis in August vs. 1.8%. Any break below 1.2500 confirms further bearishness.

USDJPY- Neutral

The pair hits its highest level since Nov 2022 on US treasury yield pullback. The policy divergence between the US Fed and BOJ supports the pair at a lower level. The significant resistance is 148/150.

GBPJPY analysis-

The near-term resistance is around 185.80, a breach above targets 186.50/187/188.50. The immediate support is at 184.80, any violation below will drag the pair to 184/183/182

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- neutral

It is good to buy on dips around 184 with SL around 183.35 for the TP of 186.65.