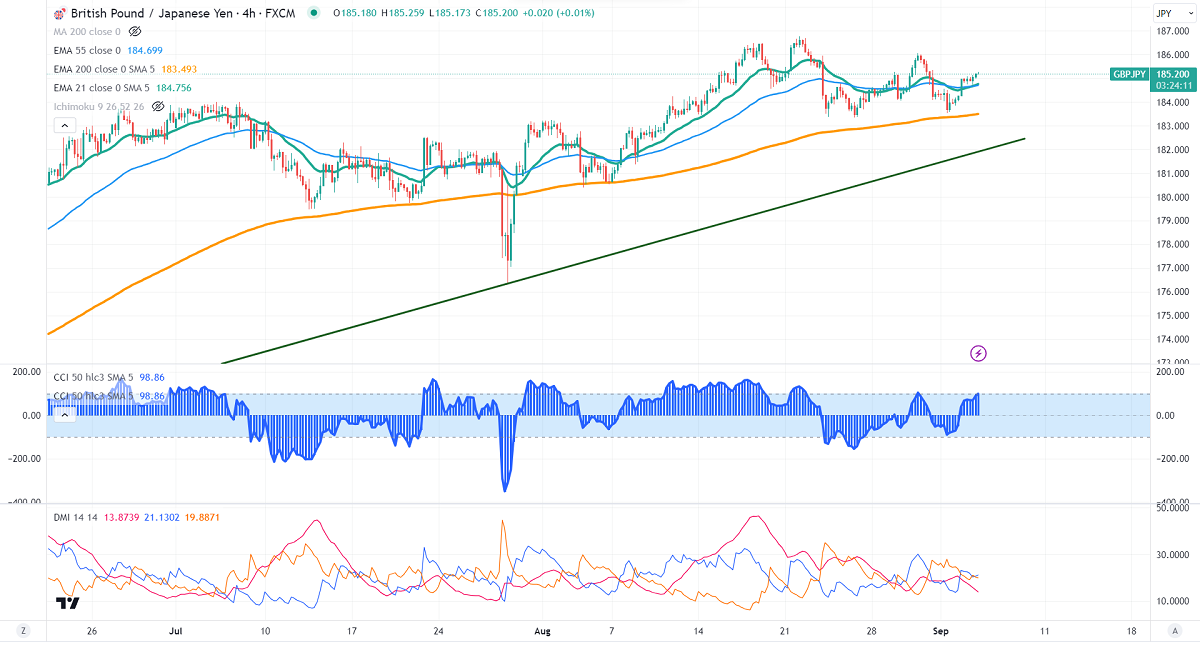

GBPJPY trading in a narrow range between 186.76 and 183.35 for the past three weeks. The weakness in the yen and pound sterling prevented the pair from further jumping. It hit a high of 185.25 at the time of writing and is currently trading around 185.22.

GBPUSD- Trend- Bearish

The pound sterling showed a minor jump on improving risk sentiment. Markets eye UK services PMI for further direction. Any break above 1.2660 confirms further bullishness.

USDJPY- Neutral

The pair trades higher despite the increase in the probability of a rate pause by the Fed in Sep meeting. The significant resistance is 146.50/147.50.

GBPJPY analysis-

The near-term resistance is around 185.50, a breach above targets 186/186.50/187/188.50. The immediate support is at 184, any violation below will drag the pair to 183/182

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- neutral

It is good to buy on dips around 184 with SL around 183.35 for the TP of 186.65.