GBPJPY showed a minor sell-off on the strong yen. It hit a low of 184.07 and is currently trading around 184.22.

GBPUSD- Trend- Bearish

The pound sterling pared some of its gains ahead of the US Nonfarm payroll. Any dismal US nonfarm employment will push the pound sterling higher. Any break above 1.2750 confirms further bullishness. Economic data to watch - UK Final Manufacturing PMI.

USDJPY- Neutral

The pair trades weak despite weak easing US treasury yields. The significant resistance is 146.50/147.50.

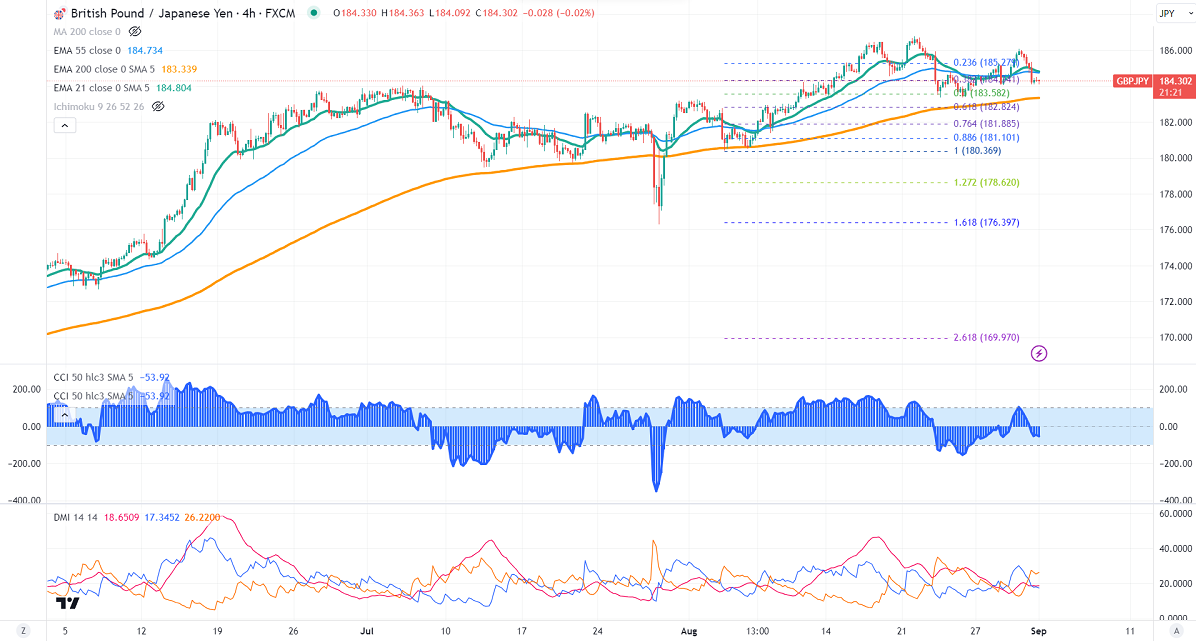

GBPJPY analysis-

The near-term resistance is around 185, a breach above targets 186/186.50/187/188.50. The immediate support is at 184, any violation below will drag the pair to 183/182

Indicators (4-hour chart)

CCI (50)- Bearish

ADX- neutral

It is good to stay away.