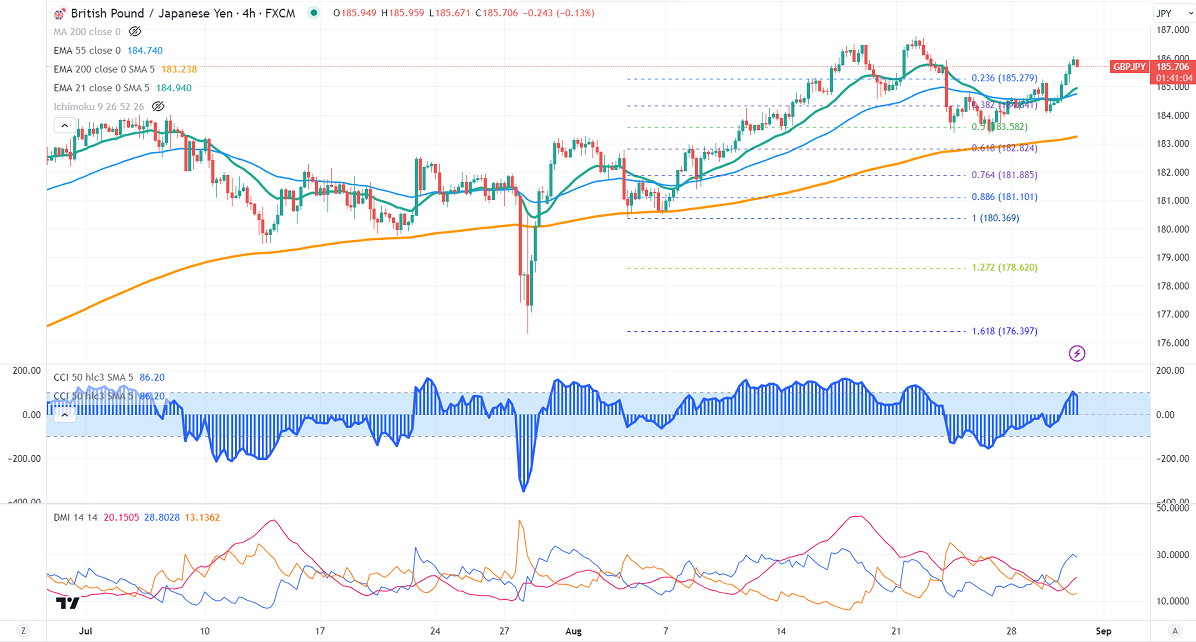

GBPJPY showed a nice pullback on the strong Pound sterling. It hit a high of 186.05 and is currently trading around 185.67.

GBPUSD- Trend- Bearish

The pound sterling jumped more than 200 pips yesterday due to weak US economic data. The US private sector has added 177000 jobs in August, below expectations of 194000. The US economy increased at an annualized pace of 2.1% in the second quarter, compared to a forecast of 2.4%.

Any break above 1.2750 confirms further bullishness. Markest eye US PCE data for further direction.

USDJPY- Neutral

The pair trades below after dismal US jobs data. The significant resistance is 147.40/148.

GBPJPY analysis-

The near-term resistance is around 186, a breach above targets 186.50/187/188.50. The immediate support is at 185.25, any violation below will drag the pair to 184.70/184/183.35.

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- Bullish

It is good to buy on dips around 185 with SL around 184 for TP of 188.