GBPJPY showed a minor pullback on the weak yen. It hit a high of 184.64 at the time of writing and is currently trading around 184.47.

GBPUSD- Trend- Bearish

The pound sterling was one of the worst performers the previous week on risk aversion. ed Chairman Powell stated in a cautious tone at the Jackson Hole symposium that the Fed Reserve may need to raise rates to tackle inflation. Markets remain silent due to the UK summer bank holiday. Any break below 1.2550 confirms further bearishness.

USDJPY- Neutral

The pair recovered higher on policy divergence between the US Fed and BOJ. The significant resistance is 146.50/148.

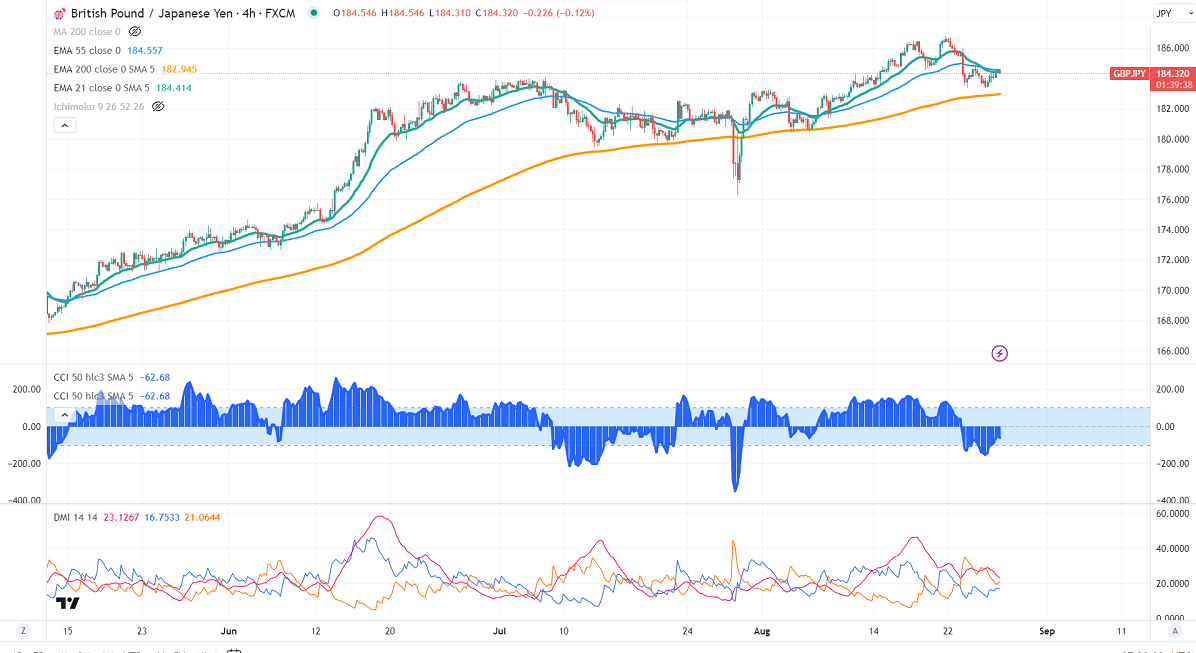

GBPJPY analysis-

The near-term resistance is around 185, a breach above targets 186.50/187/188.50. The immediate support is at 183.45, any violation below will drag the pair to 183/182.

Indicators (4-hour chart)

CCI (50)- Bearish

ADX- neutral

It is good to sell on rallies around 184.55-60 with SL around 185.50 for a TP of 180.60.