GBPJPY trades above 185.50 ahead of UK PMI data. It hit an intraday high of 185.77 and is currently trading around 185.80.

GBPUSD- Trend- Bearish

The pound sterling consolidating between 1.27874 and 1.2691 for the past four days. Any upbeat UK flash manufacturing PMI will increase the chance of a rate hike by the Bank of England. Markets eye US Flash manufacturing and services PMI, new home sales data for further movement. Any break above 1.2800 confirms further bullishness.

USDJPY- Neutral

The pair declined slightly on upbeat Japan PMI. The significant resistance is 146.60/148.

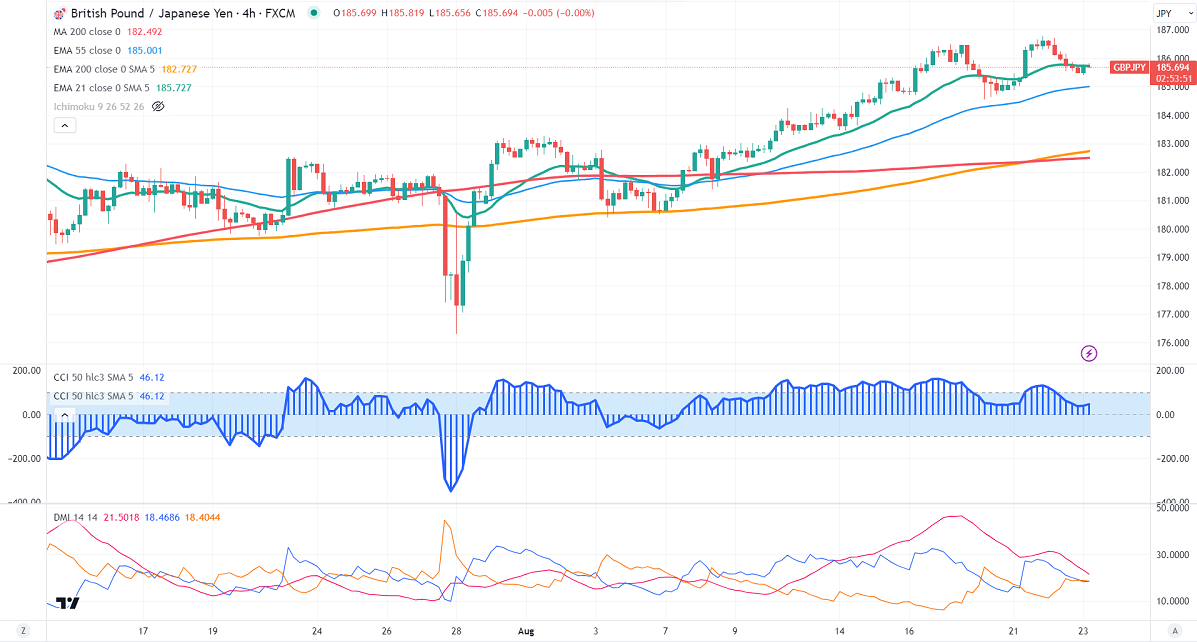

GBPJPY analysis-

The near-term resistance is around 186.60, a breach above targets 187/188.50/190. The immediate support is at 185.35, any violation below will drag the pair to 184.80/184.30/183.

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- neutral

It is good to stay away