FxWirePro- GBPJPY Daily Outlook

GBPJPY showed a minor pullback on the strong Pound sterling. It hit a high of 186.76 and is currently trading around 186.509.

GBPUSD- Trend- Bearish

The pound sterling edges towards the 1.28000 level on board-based US dollar selling. The pause in US treasury yields and cautiously optimistic market sentiment put pressure on the pair at lower levels. Markets existing home sales, Richmond manufacturing index, and Fed members speech for further direction. Any break above 1.2800 confirms further bullishness.

USDJPY- Neutral

The pair declined slightly on hawkish BOJ. The significant resistance is 146.60/148.

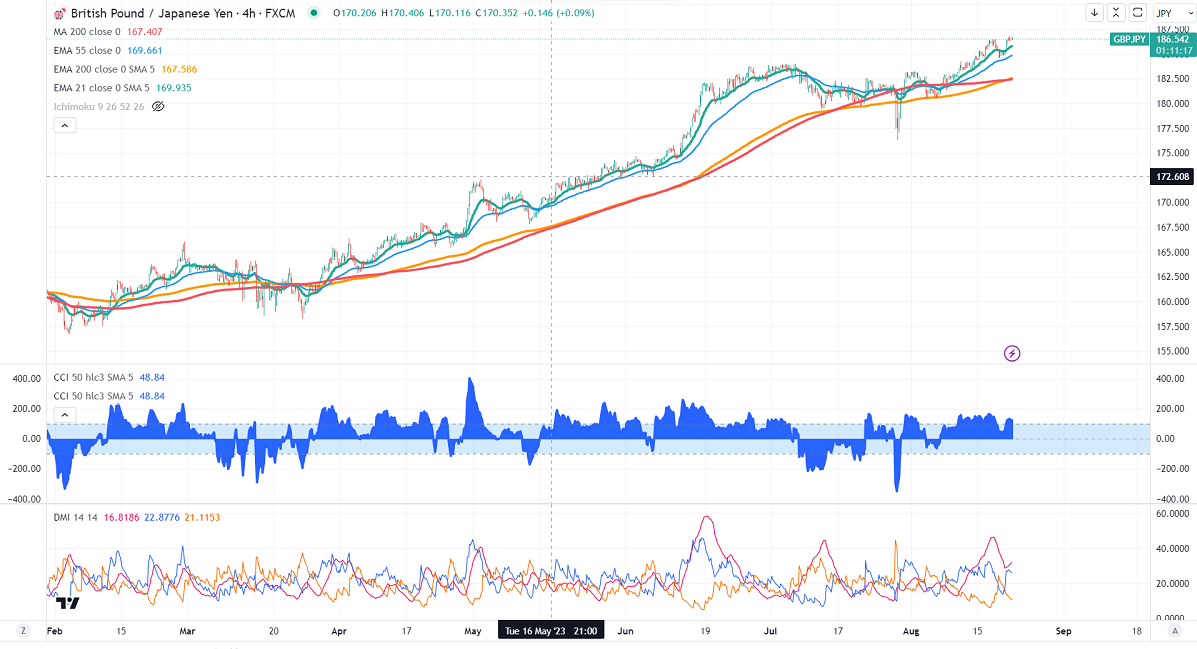

GBPJPY analysis-

The near-term resistance is around 186.60, a breach above targets 187/188.50/190. The immediate support is at 185.90, any violation below will drag the pair to 184.80/184.30.

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- neutral

It is good to stay away