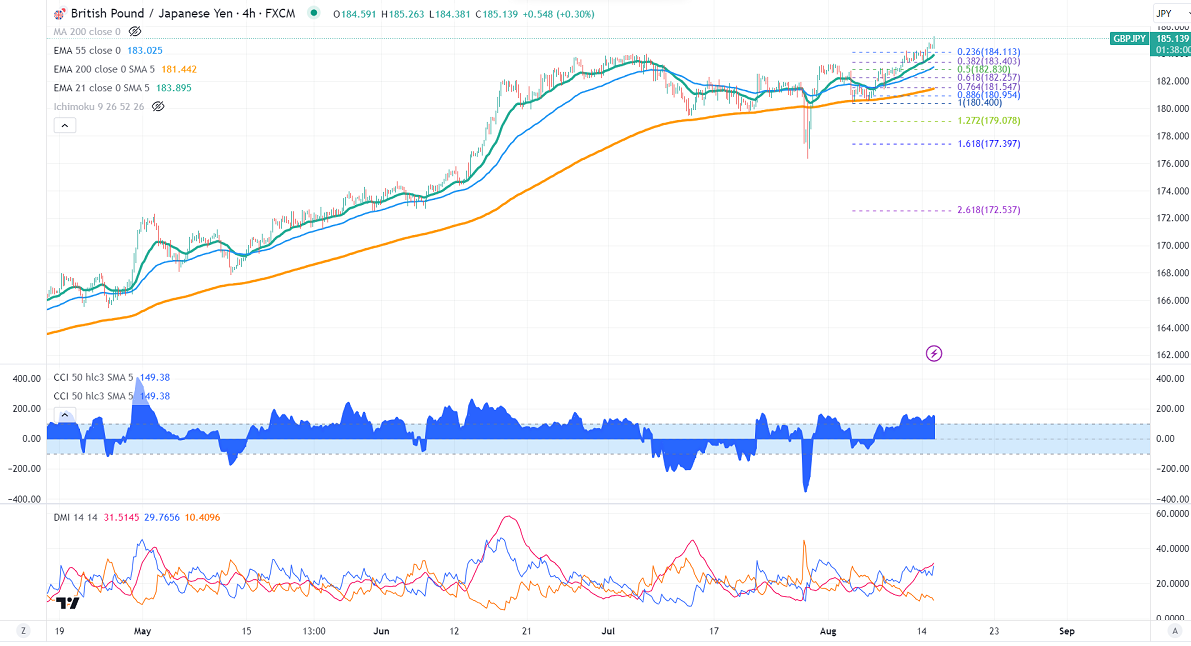

GBPJPY touched a fresh monthly high on the weak yen. It hit a high of 185.26 at the time of writing and is currently trading around 185.108.

GBPUSD- Trend- Bearish

The pound sterling showed a minor pullback after mixed UK jobs data. The ILO unemployment rate is at 4.2% vs the forecast of 4%. UK employment change was -66000 in June vs 102000 the previous month. Any break above 1.2750 confirms further bullishness.

USDJPY- Bullish

The pair showed a nice pullback despite upbeat Japanese GDP data. The significant resistance is 146/147.

GBPJPY analysis-

The near-term support is around 184.10, a breach below targets 183.45/183/182.50/181.80/181. The immediate resistance is at 185.25, any violation above will take the pair to 186/187.

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- Bullish

It is good to buy on dips around 184.50 with SL around 183.40 for a TP of 186.