GBPJPY surged more than 200 pips on the weak yen. It hit a high of 182.94 and is currently trading around 182.78.

GBPUSD- Trend- Bearish

The pound sterling consolidated in a narrow range between 1.27921 and 1.27128 for the past two days. UK BRC retail sales dropped to 1.8% YoY to an 11-month low, compared to a forecast of 3%. Market eyes Fed Member Harker's speech today for further direction. Any break above 1.2800 confirms further bullishness.

USDJPY- Neutral

The pair showed a minor decline due to weak real wages. The significant resistance is 144/145.

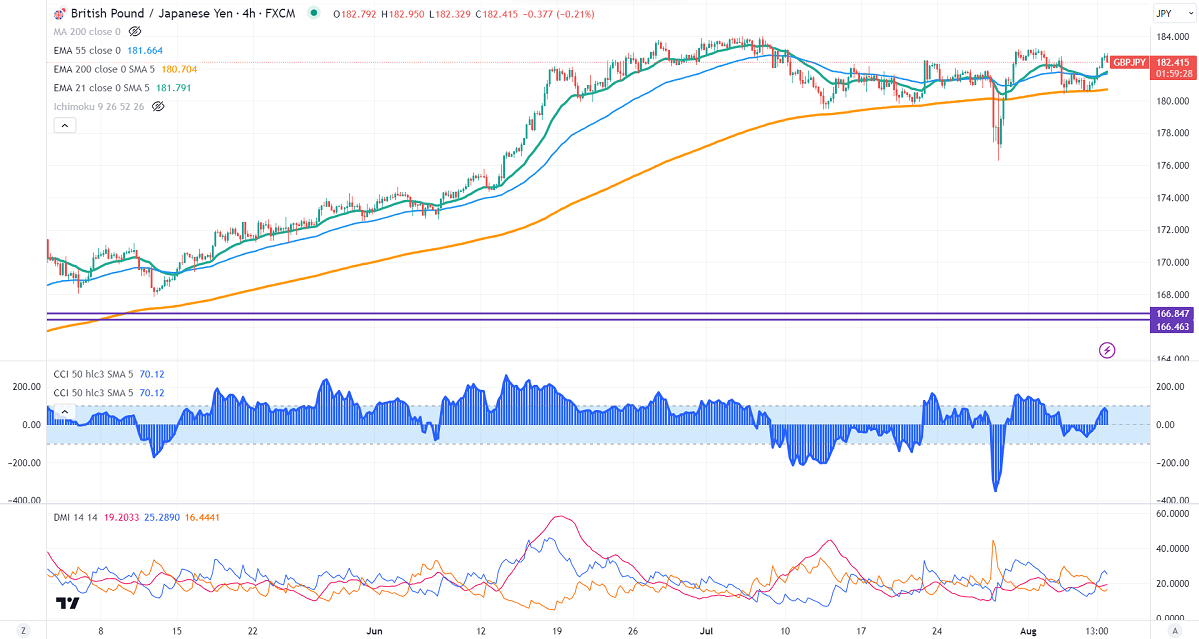

GBPJPY analysis-

The near-term support is around 182.50, a breach below the target of 181.75/181/180.40. The immediate resistance is at 183, any violation above will take the pair to 184/185.

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- Bullish

It is good to stay away.