GBPJPY lost its shine on the weak Pound sterling. It hit a low of 181.74 yesterday and is currently trading around 182.225.

GBPUSD- Trend- Bearish

The pound sterling declined sharply and hits its lowest level since Jul 7 on board-based US dollar buying. Markets eye BOE monetary policy for further direction. Any dovish rate hike will drag the pound sterling further down. Any break below 1.2675 confirms further bearishness.

USDJPY- Bullish

The pair gained momentum on surging US treasury yield. The significant resistance is 143.60/145.

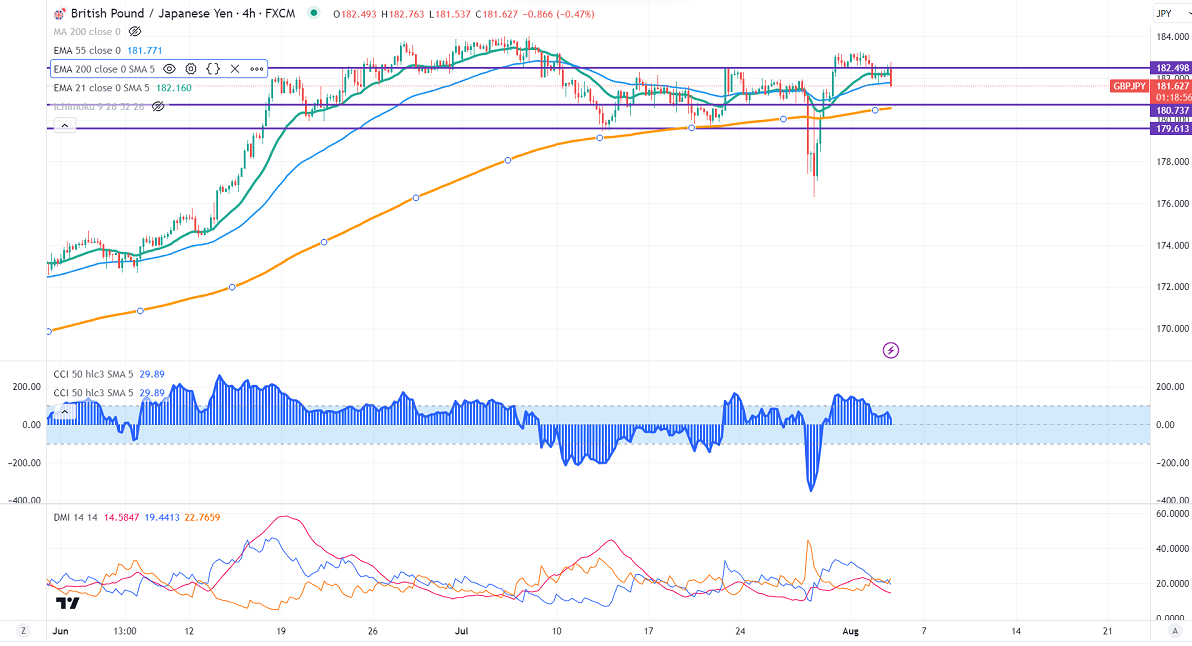

GBPJPY analysis-

The near-term support is around 181.70, a breach below the target of 180.80/180. The immediate resistance is at 182.50, any violation above will take the pair to 183.25/184.

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- Bullish

It is good to sell on rallies around 182 with SL around 183 for a TP of 178.