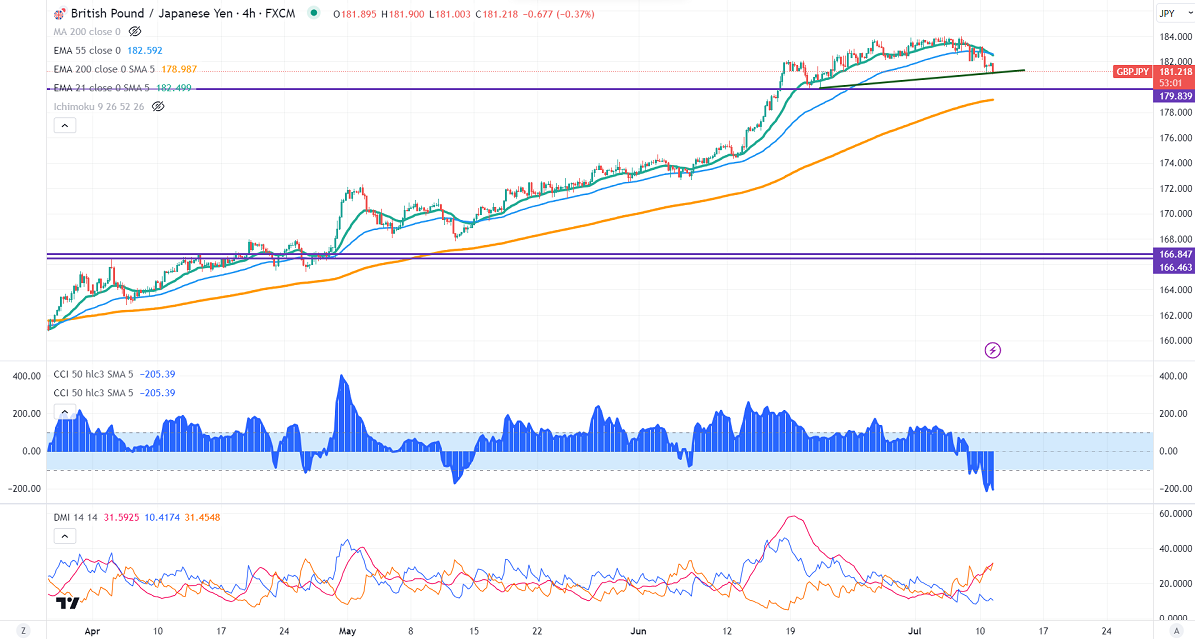

GBPJPY pared most of its gains on the strong yen. It hits an intraday low of 181 and is currently trading around 181.30.

GBPUSD- Trend- Bullish

The pound sterling hits a fresh 15-month high on board-based US dollar selling. Markets eye UK Claimant count data for further direction. Any break above 1.2850 confirms intraday bullishness.

USDJPY- Bearish

The pair declined below 141 on weak US treasury yield. Significant support is 140/139.

GBPJPY analysis-

The near-term support is around 181, a breach below targets 180/178.95. The immediate resistance is at 181.65, any violation above will take the pair to 182/183.

Indicators (4-hour chart)

CCI (50)- Bearish

ADX- Bearish

It is good to sell below 181 with SL around 182 for a TP of 178.98.