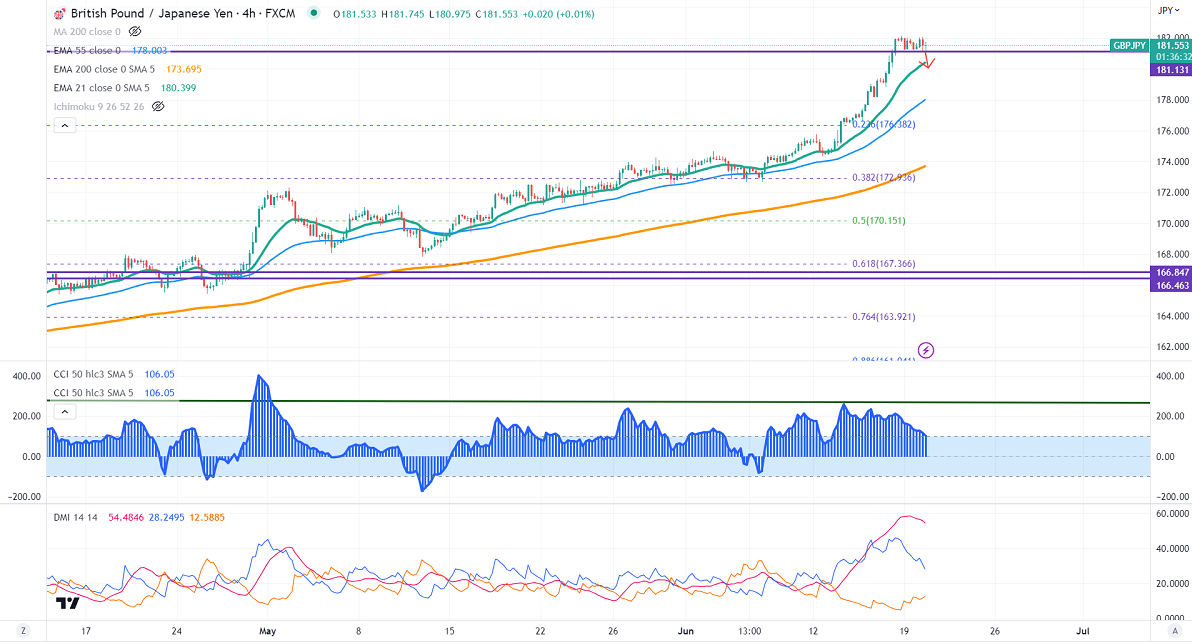

GBPJPY pared some of its gains on the weak Pound sterling. It hits an intraday low of 180.97 and is currently trading around 181.39.

GBPUSD- Trend- Bullish

The pound sterling declined slightly from a 14-month high ahead of UK CPI. Any surge in UK inflation will increase the chance of the BOE to rise rates. Any break above 1.2850 confirms further bullishness.

USDJPY- Bullish

The pair is consolidating after hitting a 7 -a month high around 142.25. Significant Resistance is 142.25/143.

GBPJPY analysis-

The near-term support is around 180.80, a breach below targets 180/178.80. The immediate resistance is at 182.40, any violation above will take the pair to 183/184.

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- Bullish

It is good to buy on dips around 180.80 with SL around 180 for a TP of 185.