GBPJPY pared some of its gains on the weak pound sterling. It hits a low of 162.40 and is currently trading around 162.55.

GBPUSD- Trend- Bearish

The pound sterling declined more than 50 pips after hawkish FOMC meeting minutes. Most Fed members agreed to a 25 bpbs rate hike and some favored 50 bpbs rate hike. Market eyes US prelim GDP q/q for further movement. Any close below 1.2000 targets 1.1900.

USDJPY- Bearish

The pair trades above 134.50 on policy divergence between US Fed and BOJ. Major resistance is 135.25/136.

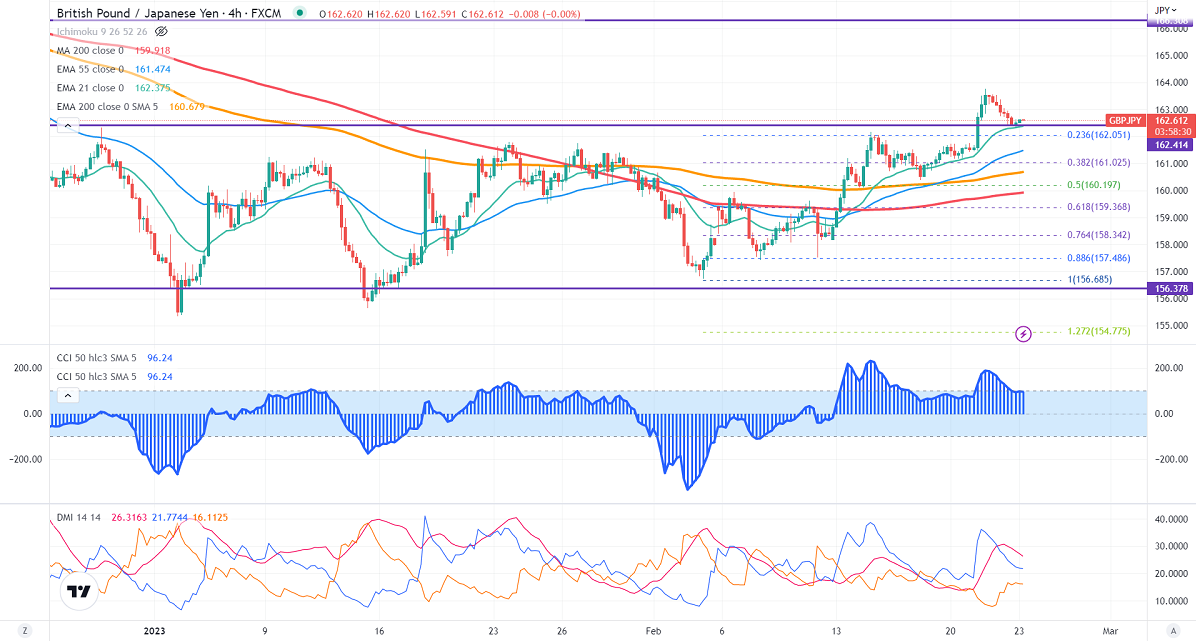

GBPJPY analysis-

The near-term support is around 162.50, a breach below targets of 162/161/160.35/160/159/158/156.70/155.60/155. The immediate resistance is at 163.75, any violation above will take the pair to 165/166.

Indicators (4-hour chart)

CCI (50) –bullish

ADX- Bullish

It is good to buy on dips around 162.50 with SL around 161.40 for a TP of 165/166.