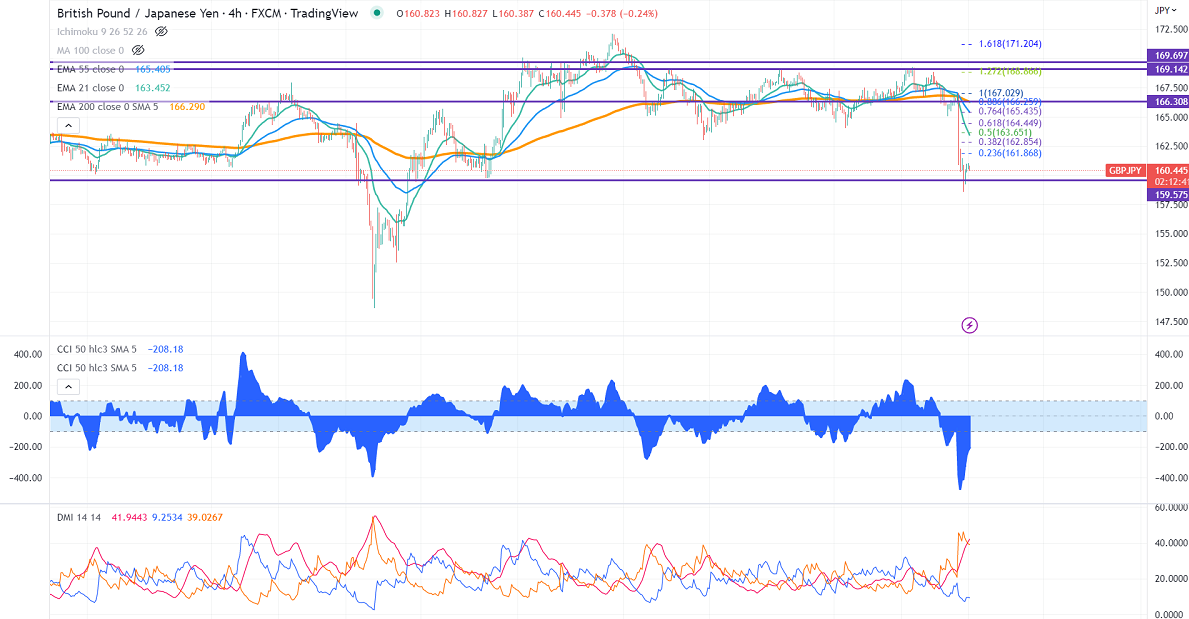

GBPJPY showed a minor pullback after a massive sell-off yesterday. It hits a high of 161.03 and is currently trading around 160.51.

GBPUSD- Trend- Bearish

The cable is struggling to extend its gains above this week's high of 1.22419. US dollar index attempting to recover due to surge in US treasury yield. Markets eye US CB consumer confidence for further direction. Any break above 1.22250 confirms further bullishness.

USDJPY- Bearish

The pair dropped more than 600 pips yesterday, the biggest slump in 24 years. Any close above 133 confirms a bullish continuation. Minor support is 131.50/130.

GBPJPY analysis-

The near-term support is around 159.70, a breach below targets 156/155. The immediate resistance is at 161, a jump above will take the pair to 161.85/163.

Indicators (4-hour chart)

CCI (50) – Bearish

ADX- Bearish

It is good to sell on rallies around 162 with SL 163 for a TP of 158.