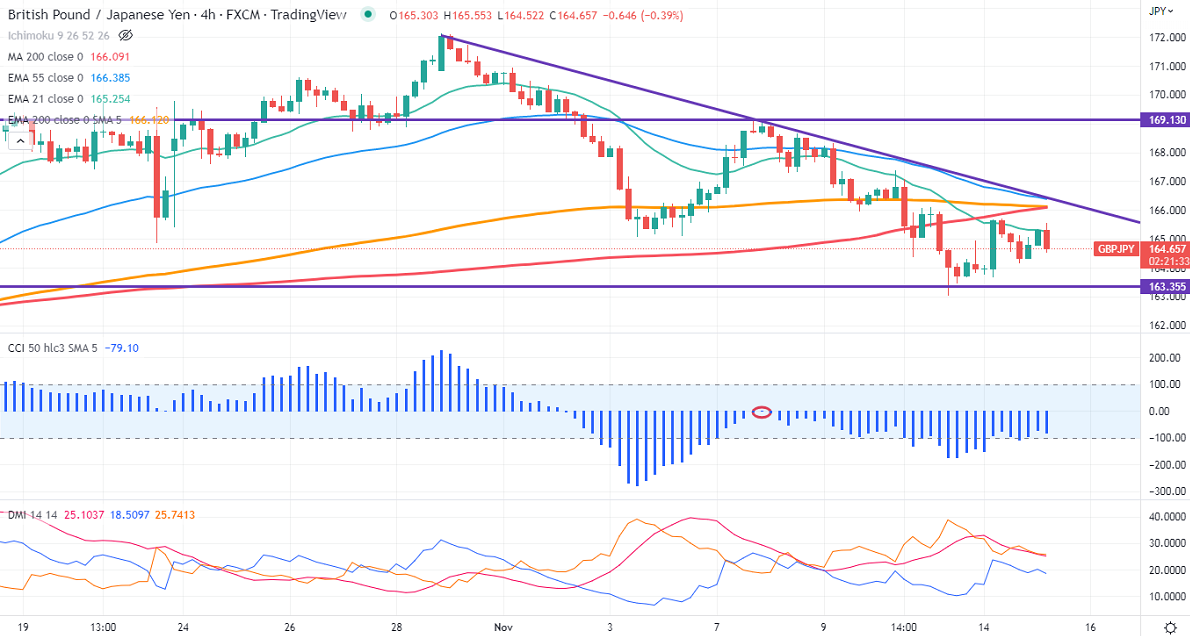

GBPJPY is trading flat after a minor pullback to 165.66. The number payrolled employees rose by 740000 in Oct from 690000 the previous month. UK unemployment rate increased to 3.6% vs the 3.5% expected. The Pound sterling gained despite weak UK jobs data. Any violation above 1.1860 confirms further bullishness; a jump to 1.2000 is possible. Technically in the 4-hour chart, GBPJPY holds below 21-EMA, 55- EMA, and long-term 200 EMA (166.19). Any convincing close above 166.25 will take to the next level 166.75/167.61/168.50. GBPJPY hits an intraday high of 165.55 and is currently trading around 164.971.

The near-term support is around 164.50, a breach below targets 163.65/163.

Indicators (4-hour chart)

CCI (50) – Bearish

ADX- Neutral

It is good to sell on rallies around 165.58-60 with SL around 166.50 for a TP of 163.