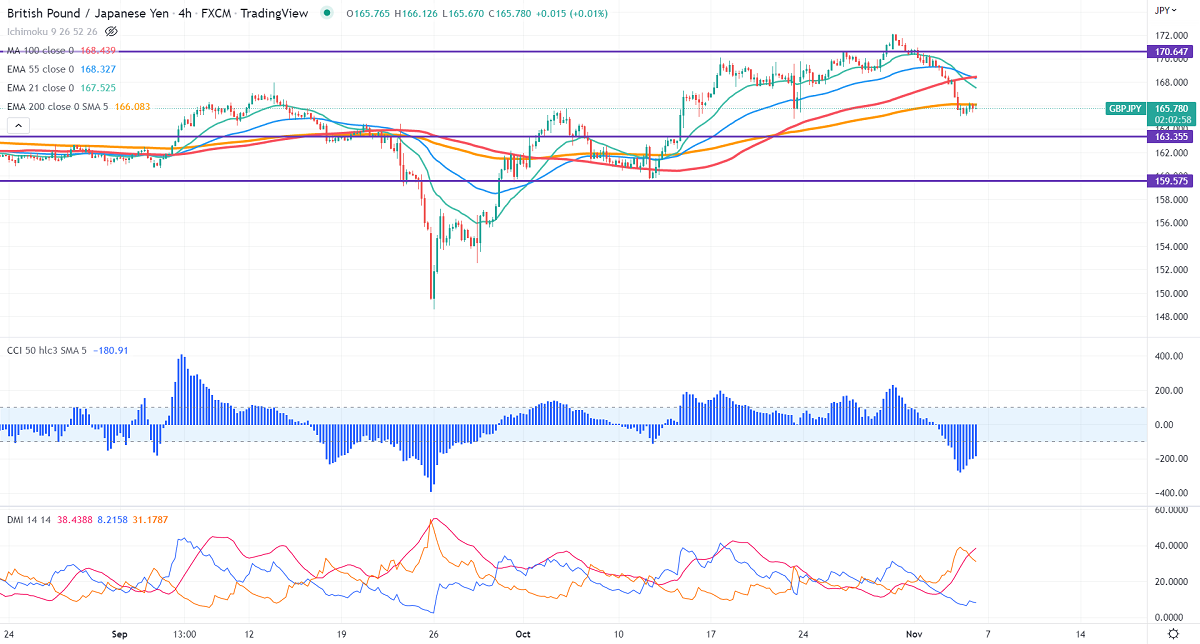

GBPJPY was one of the worst performers this week and lost more than 600 pips on the weak Pound sterling. It has pared most of its gains against the US dollar after the Bank of England kept its rates on hold. The policy divergence between Fed and BOE puts pressure on the pair at higher levels. A violation below 1.1150 confirms further bearishness, a dip to 1.100 is possible. Technically in the 4-hour chart, GBPJPY holds below short-term 21-EMA, 55- EMA, and long-term 200 EMA (166.08). Any convincing close below 165 will drag the pair to the next level 163.90/. GBPJPY hits an intraday low of 165.14 and is currently trading around 165.77.

The near-term resistance is around 166.70, a breach above targets 167.40/168.

Indicators (4-hour chart)

CCI (50) – Bearish

ADX- Bearish

It is good to sell on rallies around 166.68-70 with SL around 168 for a TP of 163.95.