Candlestick Pattern- Shooting star

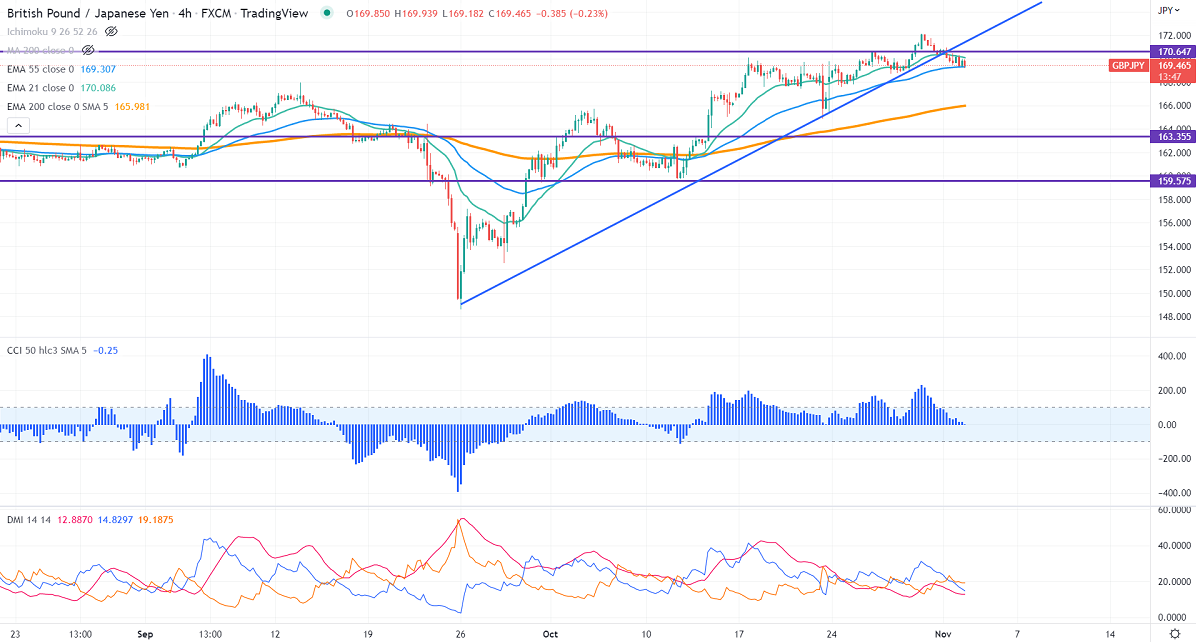

GBPJPY pared some of its gains made the previous week on profit booking. The pair was one of the best performers in the past month and surged 1000 pips on the bullish strong pound sterling. It gained sharply after the election of new UK PM Rishi Sunak. GBPUSD hovering around 1.1500 ahead of Fed monetary policy meeting. A violation above 1.15660 confirms further bullishness, a jump to 1.11650 is possible. Technically in the 4-hour chart, GBPJPY holds above short-term 21-EMA, 55- EMA, and long-term 200 EMA (165.94). Any convincing close above 168.70 will drag the pair to the next level 168/167.40. GBPJPY hits an intraday low of 169.18 and is currently trading around 169.447.

The near-term resistance is around 170, a breach above targets 172.20/175.

Indicators (4-hour chart)

CCI (50) – Bullish

ADX- neutral

It is good to sell on rallies around 169.95-170 with SL around 172 for a TP of 165.