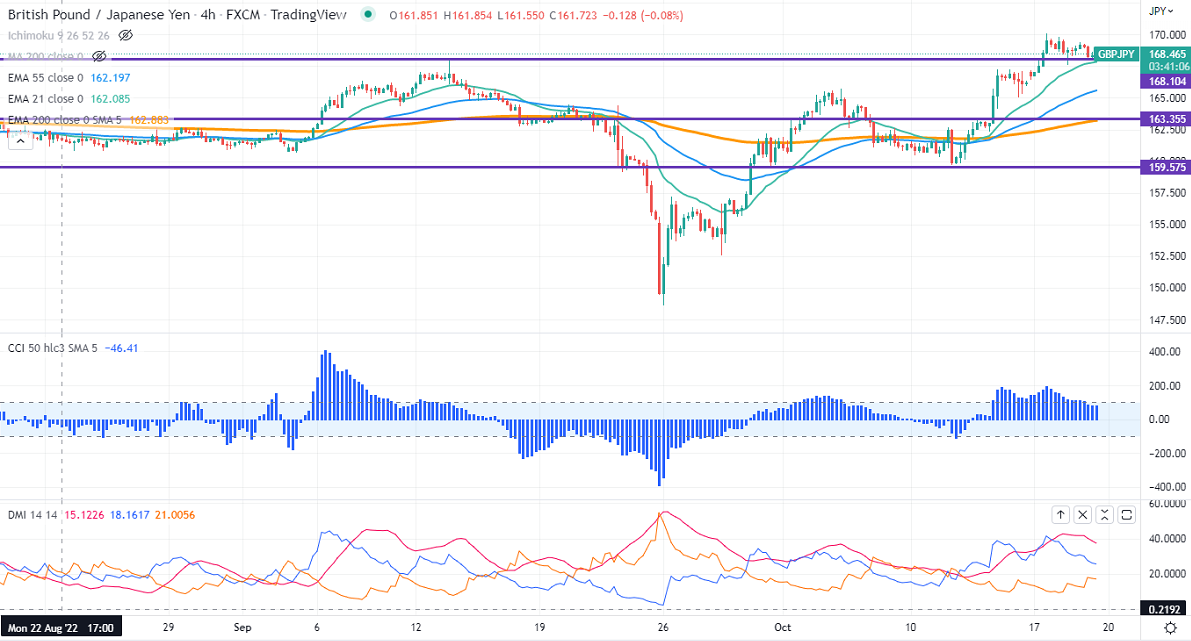

GBPJPY pared some of its gains on a minor sell-off in the pound sterling. It declined sharply despite strong UK inflation. The annualized CPI soared to 10.10% in Sep vs the forecast of 10%. Monthly CPI came at 0.5% in Sep vs 0.4 expected. Any breach below 1.1180 will drag GBPUSD to 1.0900. Technically in the 4-hour chart, GBPJPY holds above short-term 21-EMA, 55- EMA, and long-term 200 EMA (163.15). Any convincing break above 170 will take the pair to the next level 172/175. GBPJPY hits an intraday low of 168.44 and is currently trading around 167.709.

The near-term support is around 167.50, a breach below targets 166/165.

Indicators (4-hour chart)

CCI (50) – Bullish

ADX- bullish

It is good to sell on rallies around 168.45-50 with SL around 170 for a TP of 166.