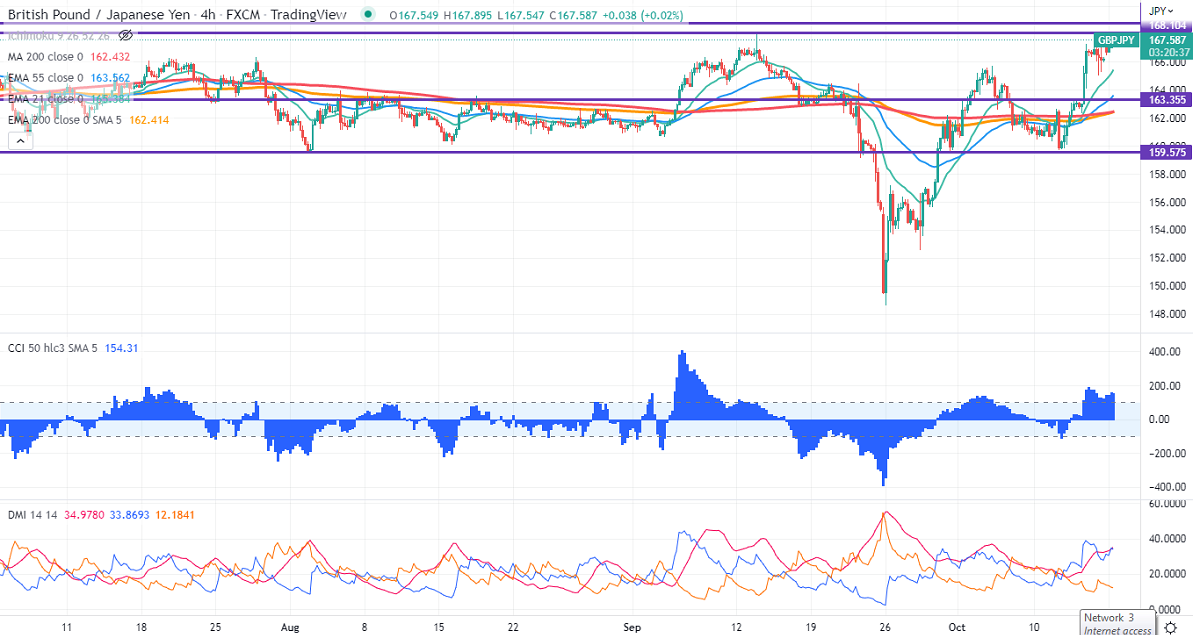

GBPJPY recovered sharply on the weak yen. The jump in Pound sterling in hopes for a decent fiscal framework from new chancellor Hunt. Bank of England Bailey's hawkish comments also support the pair at lower levels. Any breach above 1.113800 will push GBPUSD to 1.14900. Technically in the 4-hour chart, GBPJPY holds above short-term 21-EMA, 55- EMA, and long-term 200 EMA (162.36). Any convincing break above 168 will take the pair to the next level 168.75/170. GBPJPY hits an intraday high of 168.03 and is currently trading around 167.709.

The near-term support is around 166.80, a breach below targets 166/165.

Indicators (4-hour chart)

CCI (50) – Bullish

ADX- bullish

It is good to buy on dips around 166.75-80 with SL around 165.50 for a TP of 168/169.