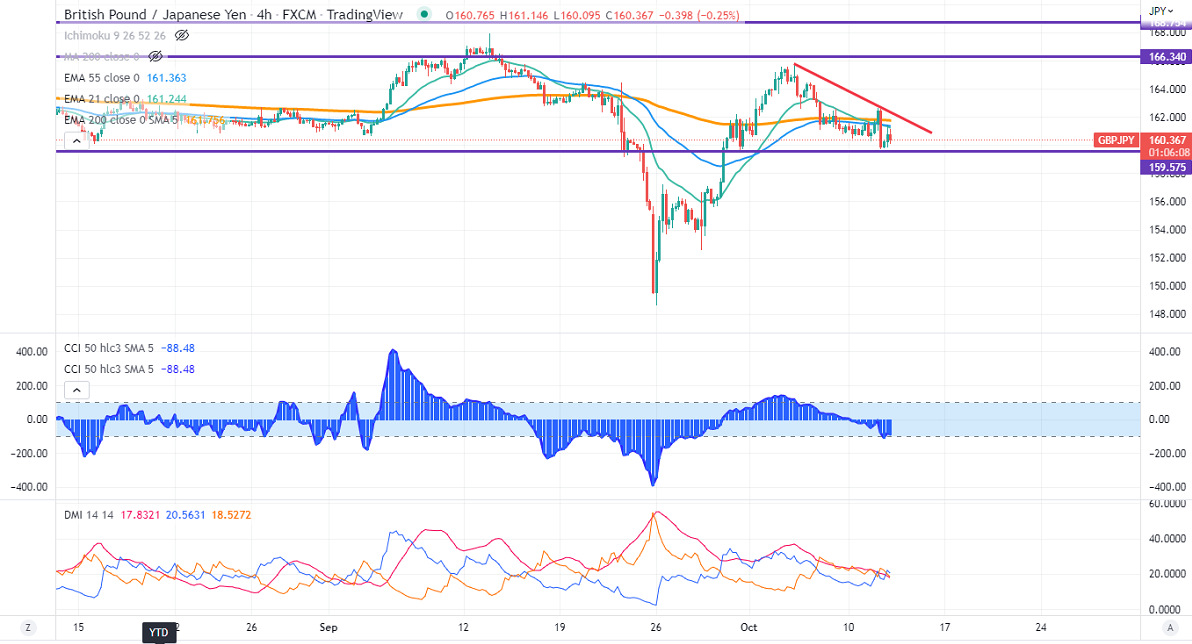

GBPJPY trades weak after dismal UK data. The economy shrank by 0.30% in August from Jul due to weakness in the manufacturing sector. The pound sterling pared some of its gains despite the extension of bond buying. The geopolitical tension between Russia and Ukraine also puts pressure on cable at higher levels. . Any breach below 1.0900 confirms further bearishness. Technically in the 4-hour chart, GBPJPY holds below short-term 21-EMA,55- EMA, and long-term 200 EMA (161.78). Any convincing break below 159 will take the pair to the next level 158/155.60. GBPJPY hits an intraday high of 161.50 and is currently trading around 160.48.

The near-term resistance is around 161.87, a breach above targets 162.70/163.40/164.45.

Indicators (4-hour chart)

CCI (50) – Bearish

ADX- Neutral

It is good to sell on rallies around 161.45-50 with SL around 162.50 for a TP of 159/158.

FxWirePro- GBPJPY Daily Outlook

Wednesday, October 12, 2022 8:01 AM UTC

Editor's Picks

- Market Data

Most Popular