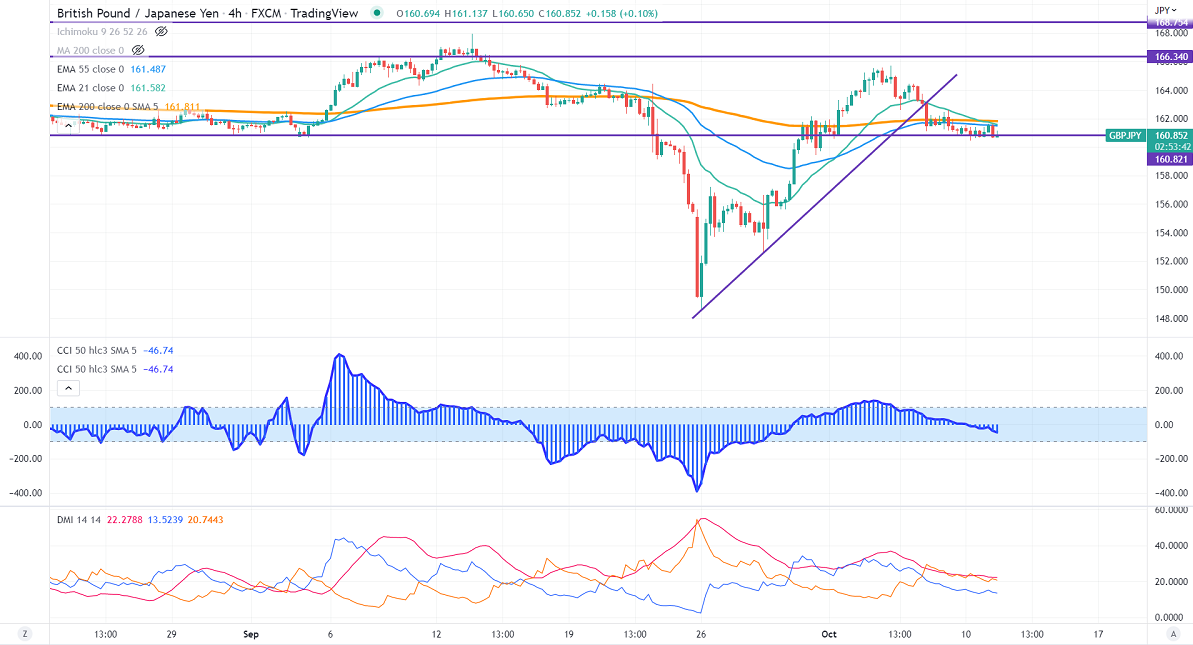

GBPJPY trades flat ahead of UK employment data. The pound sterling lost its shine despite the BOE emergency bond-buying program. The demand for the USD increased due to the escalation of tension between Russia and Ukraine. Markets eye UK claimant count change and BOE Bailey's speech for further direction. Any breach below 1.1000 confirms further bearishness Technically in the 4-hour chart, GBPJPY holds below short-term 21-EMA,551 EMA, and long-term 200 EMA (161.87). Any convincing break below 160 will take the pair to the next level 159/158. GBPJPY hits an intraday high of 161.13 and is currently trading around 160.99.

The near-term resistance is around 161.87, a breach above targets 162.70/163.40/164.45.

Indicators (4-hour chart)

CCI (50) – Bearish

ADX- Neutral

It is good to sell on rallies around 161.45-50 with SL around 162.50 for a TP of 159/158.