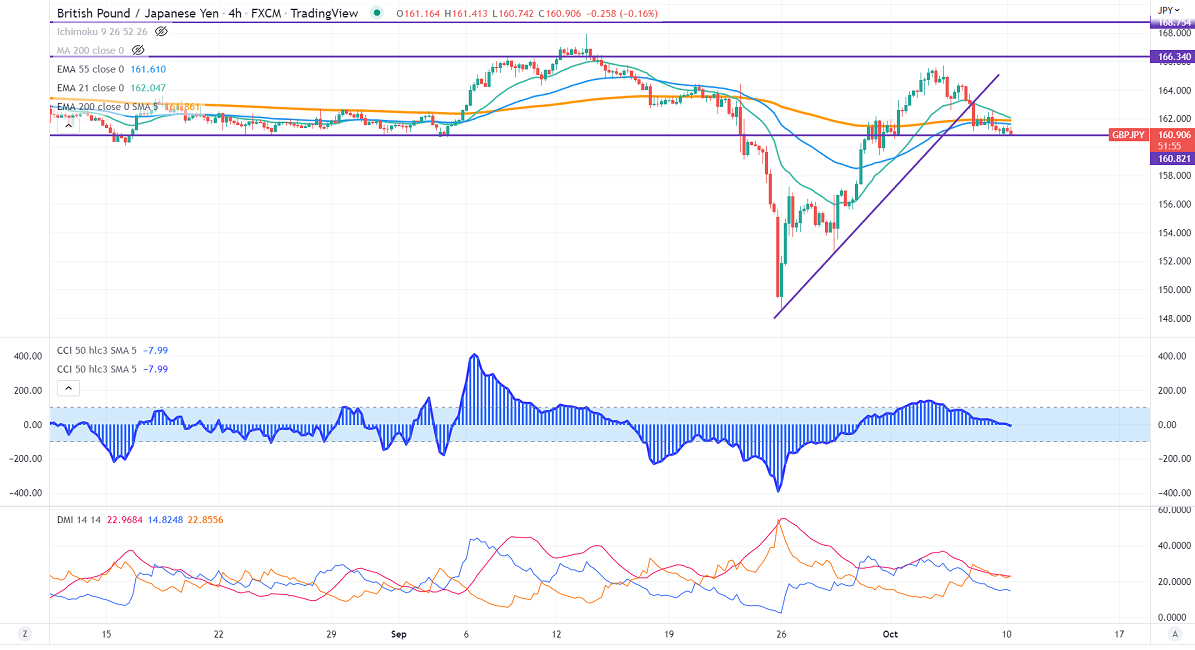

GBPJPY trades weak for the past three days on the declining Pound Sterling. It rebounded slightly against the US dollar after BOE measures to ease market turmoil. It has announced a two-week emergency purchase program to double the size of gilts buying. Any breach above 1.1200 confirms intraday bullishness. Technically in the 4-hour chart, GBPJPY holds below short-term 21-EMA,551 EMA, and long-term 200 EMA (161.87). Any convincing break below 160.75 will take the pair to the next level 160/159/158. GBPJPY hits an intraday low of 160.72 and is currently trading around 161.05.

The near-term resistance is around 161.87, a breach above targets 162.70/163.40/164.45.

Indicators (4-hour chart)

CCI (50) – Neutral

ADX- Neutral

It is good to sell on rallies around 161.45-50 with SL around 162.50 for a TP of 159/158.