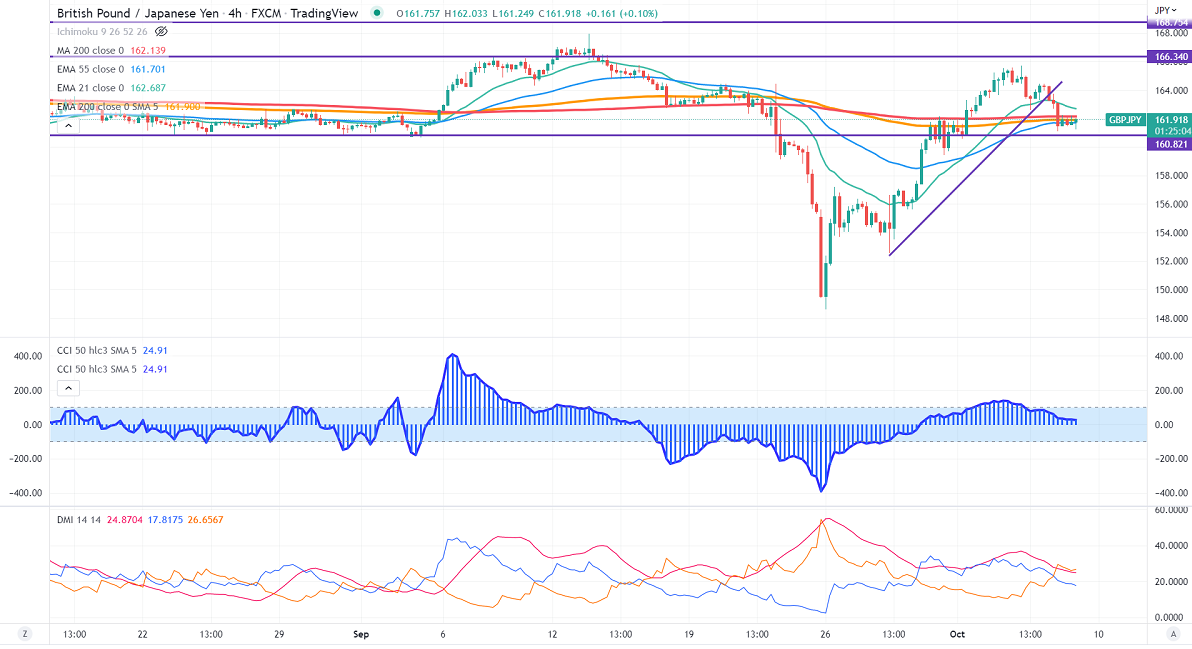

GBPJPY showed a massive sell-off on the weak Pound sterling. Most economists including Fitch lowered the forecasts for UK economic growth and have predicted deeper recession due to elevated inflation. The pound sterling lost more than 375 pips from its high of 1.14952. Any close below 1.100 confirms further bearishness. Technically in the 4-hour chart, holds below short-term 21-EMA,551 EMA, and long-term 200 EMA (161.88). Any convincing break below 161 will take the pair to the next level 160/159/158. GBPJPY hits an intraday low of 161.24 and is currently trading around 162.40.

The near-term resistance is around 162.25, a breach above targets 162.70/163.40/164.45.

Indicators (4-hour chart)

CCI (50) – Bullish

ADX- Neutral

It is good to sell on rallies around 162.45-50 with SL around 163.50 for a TP of 160/159.