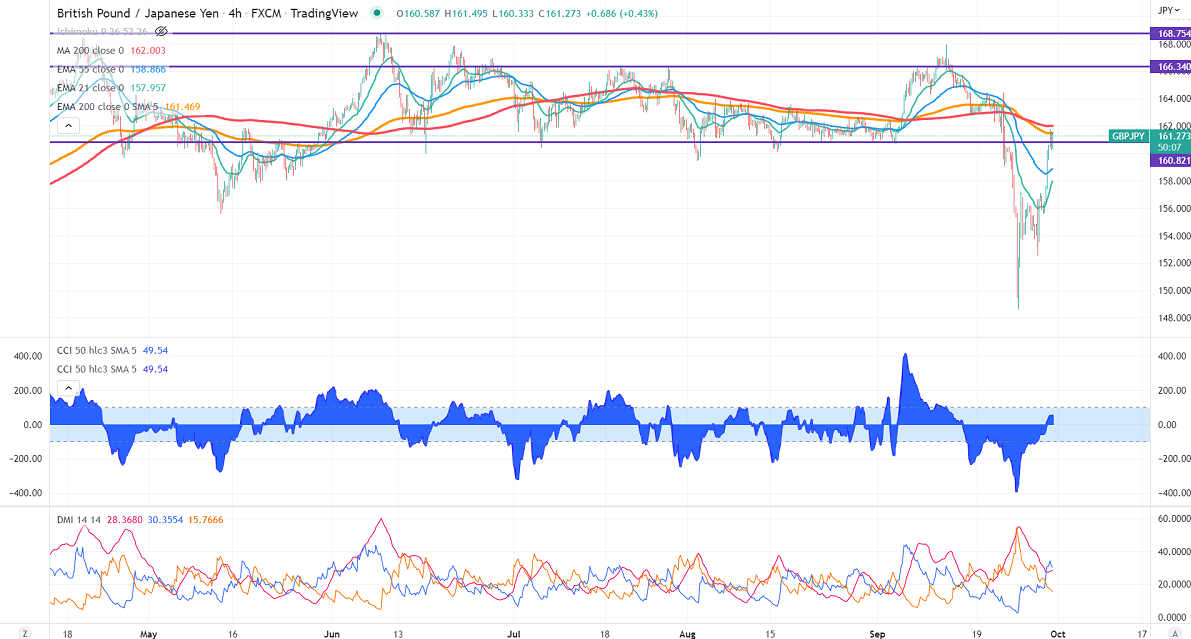

GBPJPY recovered more than 1300 pips from a low of 148.63 on the strong Pound sterling. It surged sharply against the US dollar on board-based dollar selling. UK GDP grew to 0.2% QoQ compared to a forecast of -0.10%. The yearly figures came at 4.4%, well above the estimate of 2.90%. Technically in the 4-hour chart, holds above short-term 21-EMA, 21 EMA, and below long-term 200 EMA (161.95). Any convincing break above 162.20 will take the pair to the next level 163.45/164. GBPJPY hits an intraday high of 161.74 and is currently trading around 160.96.

The near-term support is around 160, a breach below targets 159/158.50.

Indicators (4-hour chart)

CCI (50) – Bullish

ADX- Bearish

It is good to buy on dips around 160 with SL around 159 for TP of 163.