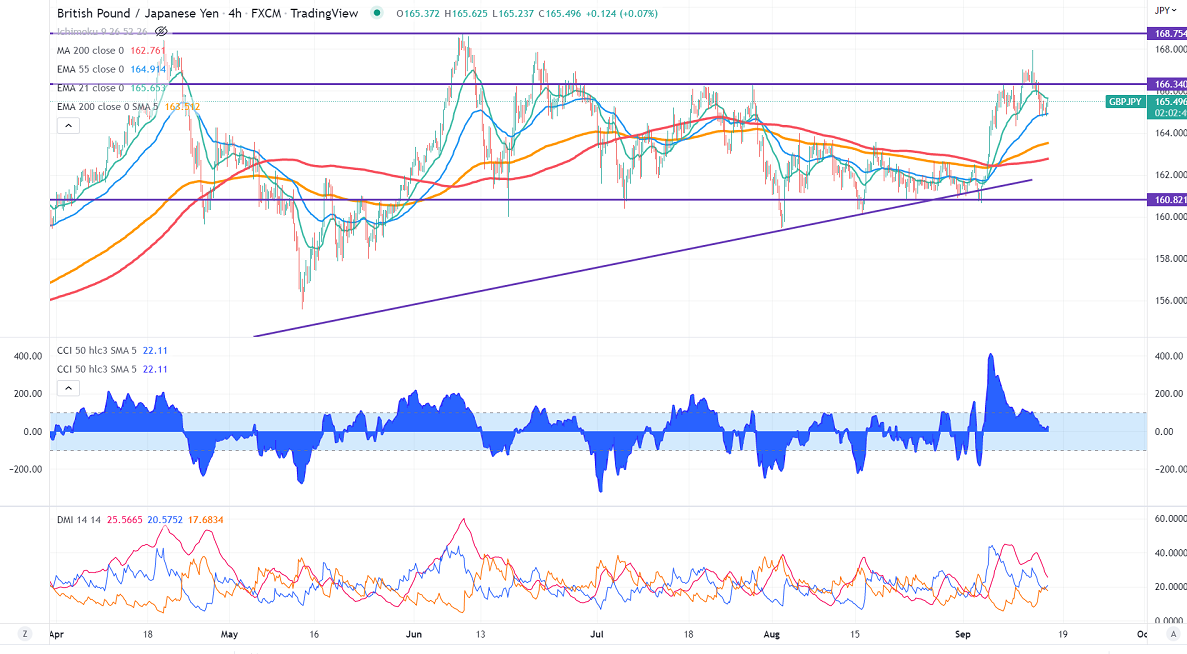

GBPJPY declined more than 300 pips on a strong yen. It gained sharply against the US dollar after as BOJ plans to intervene to prevent yen appreciation. The yen pared some of its gains after a record trade deficit on rising energy imports. Technically 4-hour chart, holds below short-term 21-EMA, above 55 EMA, and long-term 200 EMA (163.49). Any decline below 164.75 will take the pair to the next level 164.30/163. GBPJPY hits an intraday high of 165.45 and is currently trading around 165.32.

The near-term resistance is around 165.60, a breach above targets 166.35/167/168/168.70.

Indicators (4-hour chart)

CCI (50) – Bullish

ADX- Neutral

It is good to sell on rallies around 165.95-66 with SL around 167 for TP of 164.50.