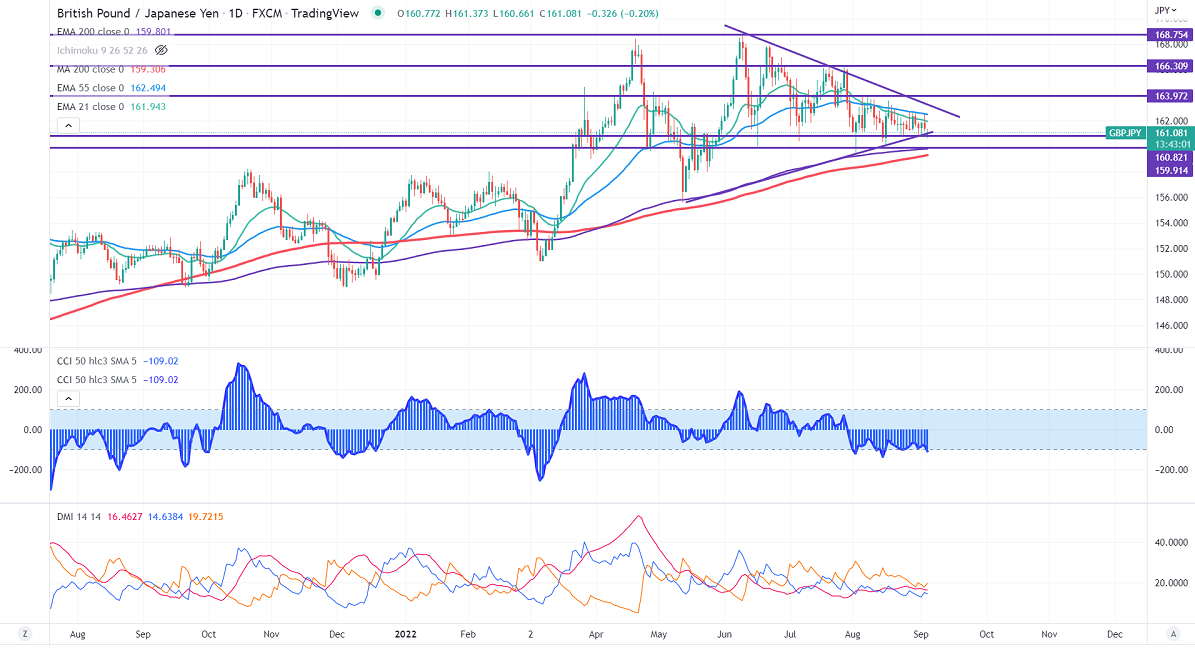

GBPJPY pared most of its gains on the weak pound sterling. It hits two years low against the US dollar on board-based dollar buying. Markets eye the UK election result for further direction. The surge in European gas price as Russia keeps the NordStream link shut increases the chance of a recession in the U.K. Technically in the daily chart, the pair is holding below above short-term 21-EMA, 55 EMA, and above long-term 200 EMA (159.78). Any daily below 159.75takes to the next level 159/158. GBPJPY hits an intraday low of 160.66 and is currently trading around 161.06.

The near-term resistance is around 161.65, a breach above targets 162.50/163/164.

Indicators (Daily chart)

CCI (50) – Bullish

ADX- Neutral

It is good to avoid it till further confirmation.