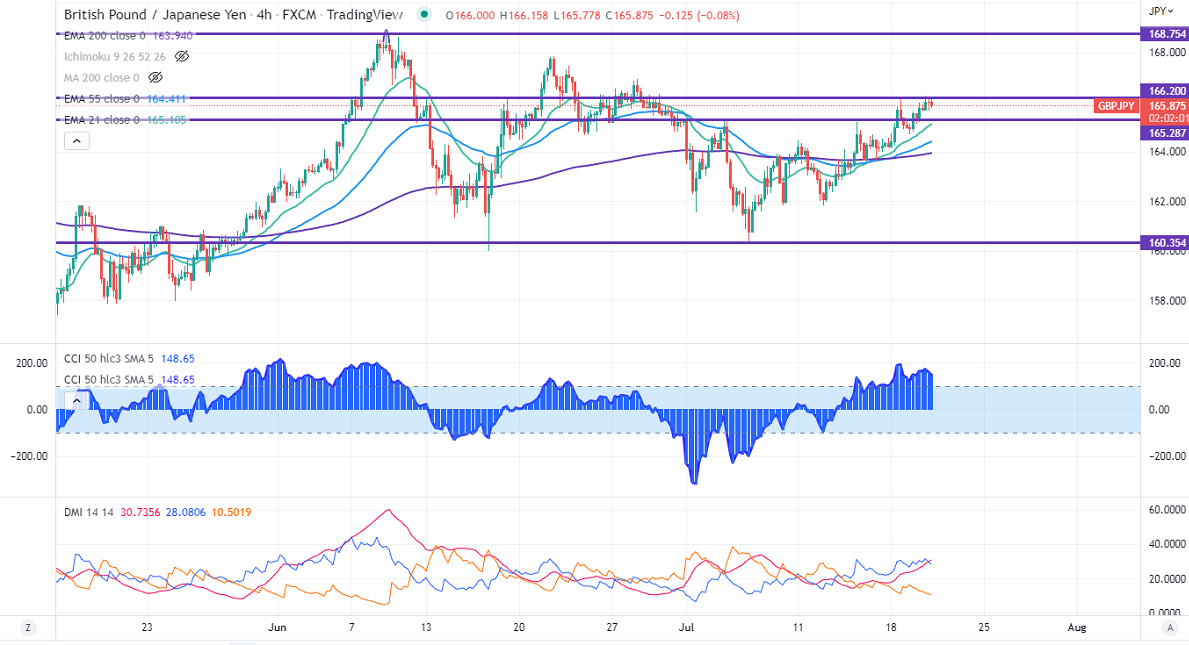

GBPJPY gained sharply yesterday on the strong Pound sterling. It has pared some of its gains made in the Asian session on upbeat UK CPI data. The annualized inflation rose by 9.4% in June compared to a forecast of 9.3%. Any break below 1.1980 confirms further bearishness. Technically in the 4-hour chart, the pair is holding above short-term 21-EMA, 55 EMA, and long-term 200 EMA (163.72). Any breach below 165.50 will drag the pair down to take to the next level to 165/164.70/163.97. GBPJPY hits an intraday low of 165.66 and is currently trading around 165.96.

The near-term resistance is around 166.25, any breach above targets 167/168.

Indicators (4-hour chart)

CCI (50) - Bullish

ADX- Bullish

It is good to sell on rallies around 166.10-15 with SL around 167 for TP of 163.