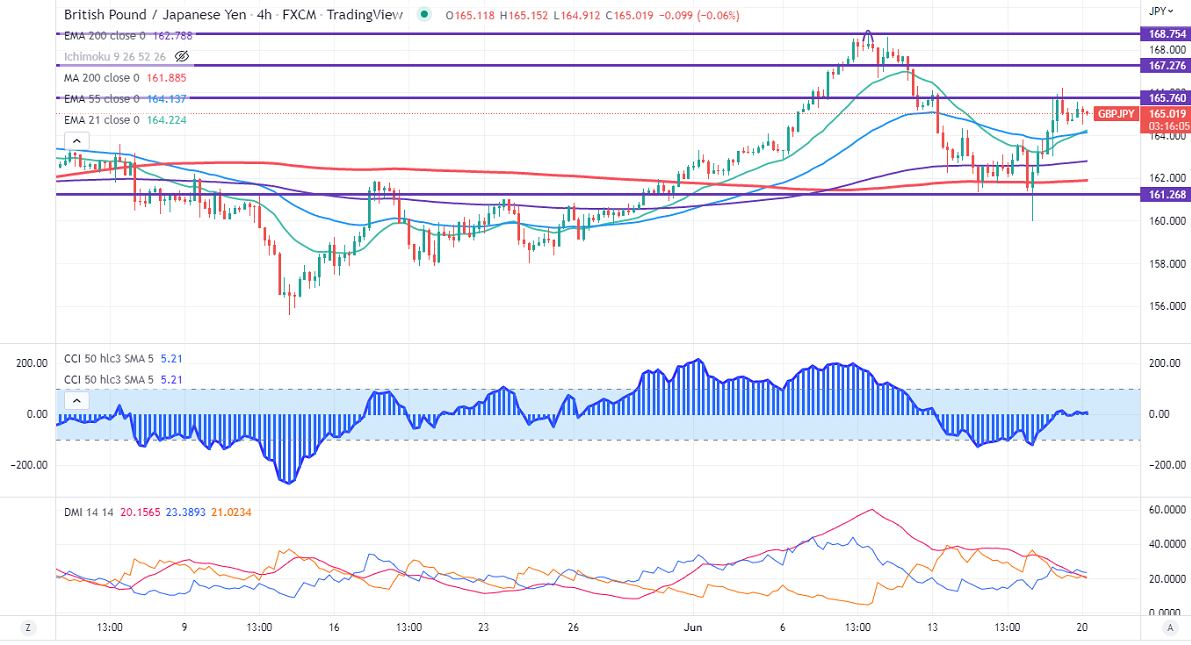

GBPJPY recovered sharply after a massive sell-off of more than 500 pips. The pound sterling jumped from two years low of 1.19334 as BOE hiked rates by 25 bpbs for the second consecutive time. Markets eye UK CPI data which is to be released on Wednesday for further direction. A breach above 1.2300 confirms intraday bullishness. Technically in the 4-hour chart, the pair is holding above short term (21- and 55 EMA) and 200 MA (161.87). Any close below 161.80 will drag the pair down to 160/159. GBPJPY hits an intraday low of 164.47 and is currently trading around 165.05.

The near-term resistance is around 166.25, any breach above targets 167/168./168.75.

Indicators (4-hour chart)

CCI (50)-Neutral

ADX- Neutral

It is good to buy on dips around 164 with SL around 163 for TP of 167.