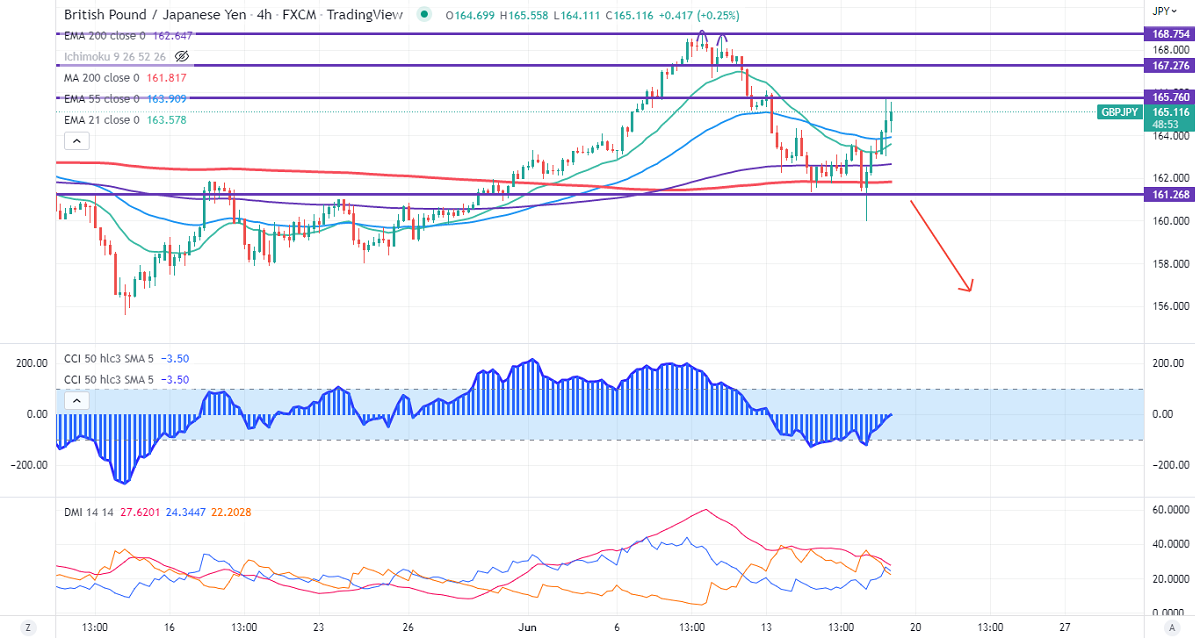

GBPJPY surged sharply and gained more than 500 pips on a sharp u-turn in the Japanese yen. The minor pullback in pound sterling also supports the pair at lower levels. It has pared some of its gains made yesterday as weak economic data will prevent BOE from an aggressive rate hike. Any breach above 1.2430 confirms a minor bullish trend. Technically in the 4-hour chart, the pair is holding above short term (21- and 55 EMA) and above 200 MA (161.80). Any close above 165.80 will take the pair to 166.70/167.80/168.85. GBPJPY hits an intraday high of 165.55 and is currently trading around 165.11.

The near-term support is around 163.90, any breach below targets 163/162.60/161.75.

Indicators (4-hour chart)

CCI (50)- Bearish

ADX- Bearish

It is good to buy on dips around 164 with SL around 163 for TP of 167.80/168.80.