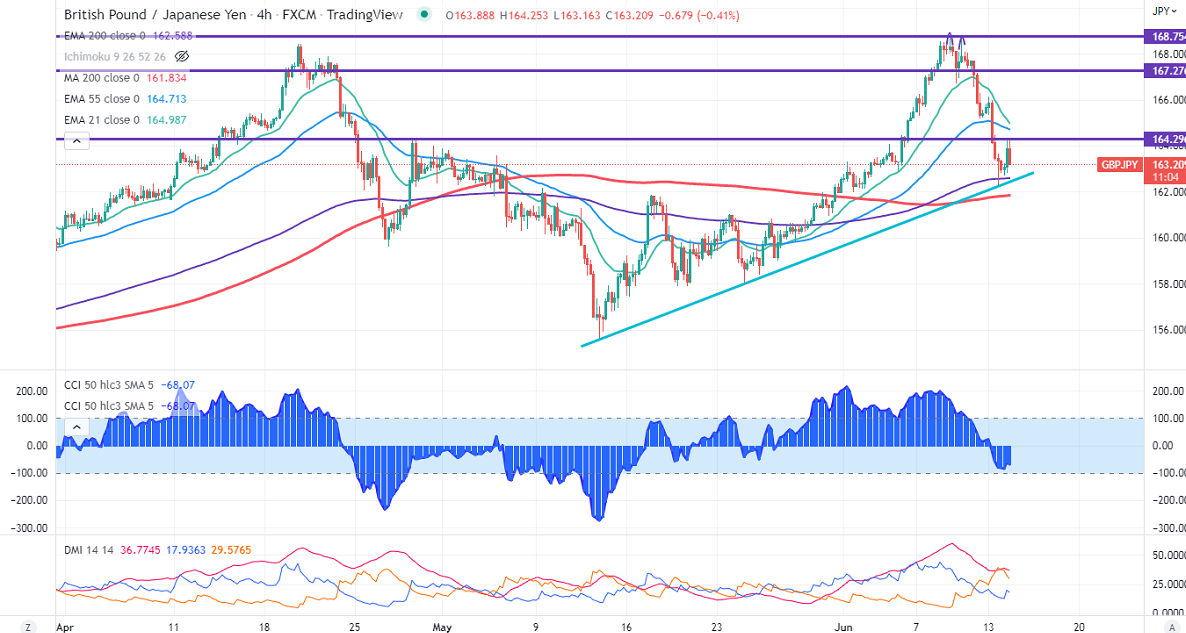

GBPJPY showed a minor pullback from a low of 162.25 levels. The pound sterling pared some of its gains made during the Asian session after dismal UK unemployment data. It rose unexpectedly to 3.8% in Apr. Technically in the 4-hour chart, the pair is holding below short term (21- and 55 EMA) and 200 MA (164.67). Any break below 163.50 will drag the pair down to 162.68/162. GBPJPY hits an intraday low of 163.329 and is currently trading around 163.34.

The near-term resistance is around 164.35, any breach above targets 165/165.31/166.15.

Indicators (Hourly chart)

CCI (50)- Bearish

ADX- Neutral

It is good to sell on rallies around 163.48-50 with SL around 164.32 for TP of 162/160.