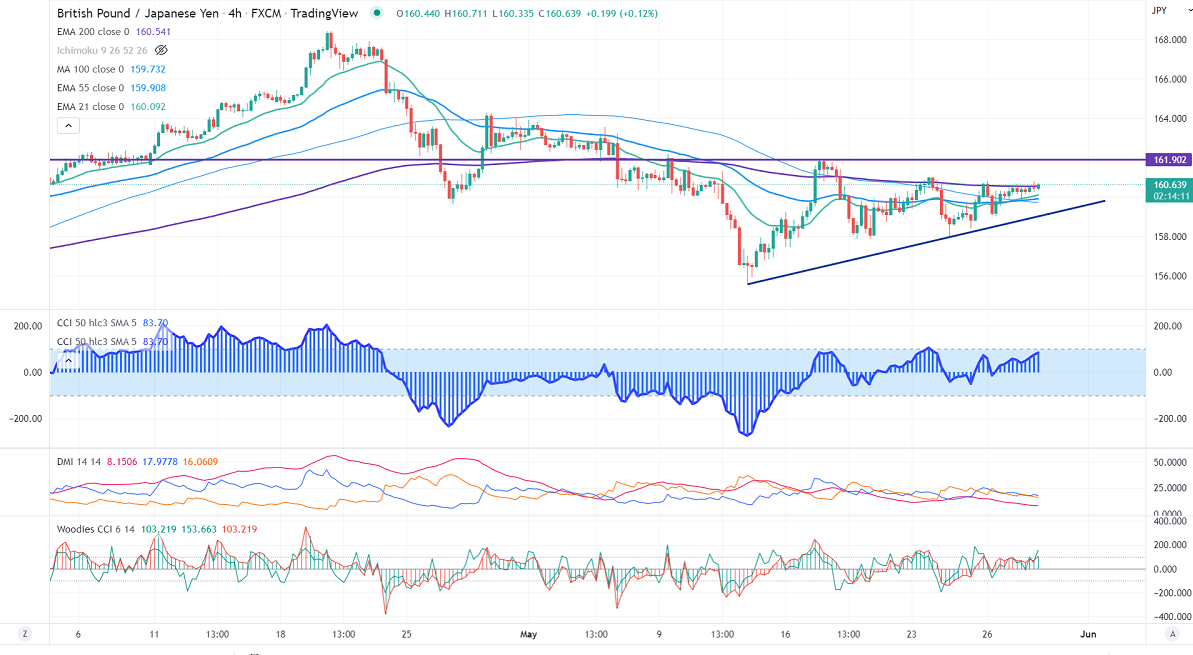

GBPJPY regained above 160 on the strong Pound sterling. It recovered sharply after the UK government-approved 15-billion pounds to support households. The board-based US dollar weakness also supports the pound at lower levels. Any close above 1.2670 confirms further bullishness. GBPJPY hits an intraday high of 160.71 and is currently trading around 160.637.

USDJPY

USDJPY continues to trade lower on the weak US dollar. The overall trend is still bearish, a dip to 125 is possible.

Technicals:

On the lower side, immediate support is around 159, breach below will drag the pair to the next level to 158/157/155. The minor resistance to be watched is around 161.20, a break above that level confirms intraday bullishness, and a jump to 162/164.25/165 is possible.

It is good to stay away.