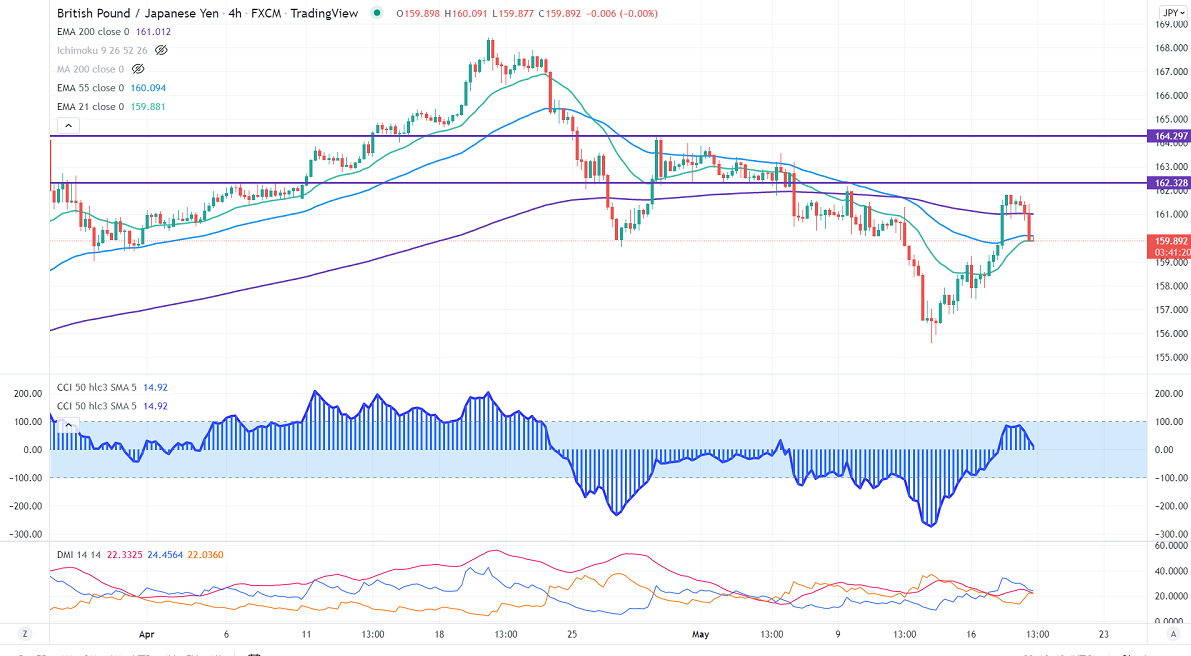

GBPJPY declined sharply after upbeat UK inflation data. The yearly CPI came at 9% in Apr 40-year high as energy prices soars. Any breach below 1.2350 confirms intraday bearishness. GBPJPY hits an intraday low of 159.85 and is currently trading around 159.92.

USDJPY

USDJPY trades weak on board-based US dollar selling. The intraday bearishness is only below 128.50.

Technicals:

On the lower side, immediate support is around 160, breach below will drag the pair to the next level to 159/157.95/157/155. The minor resistance to be watched is around 162, a break above that level confirms intraday bullishness, and a jump to 164.25/165 is possible.

It is good to sell on rallies around 160.45-50 with SL around 162 for the TP of 157.