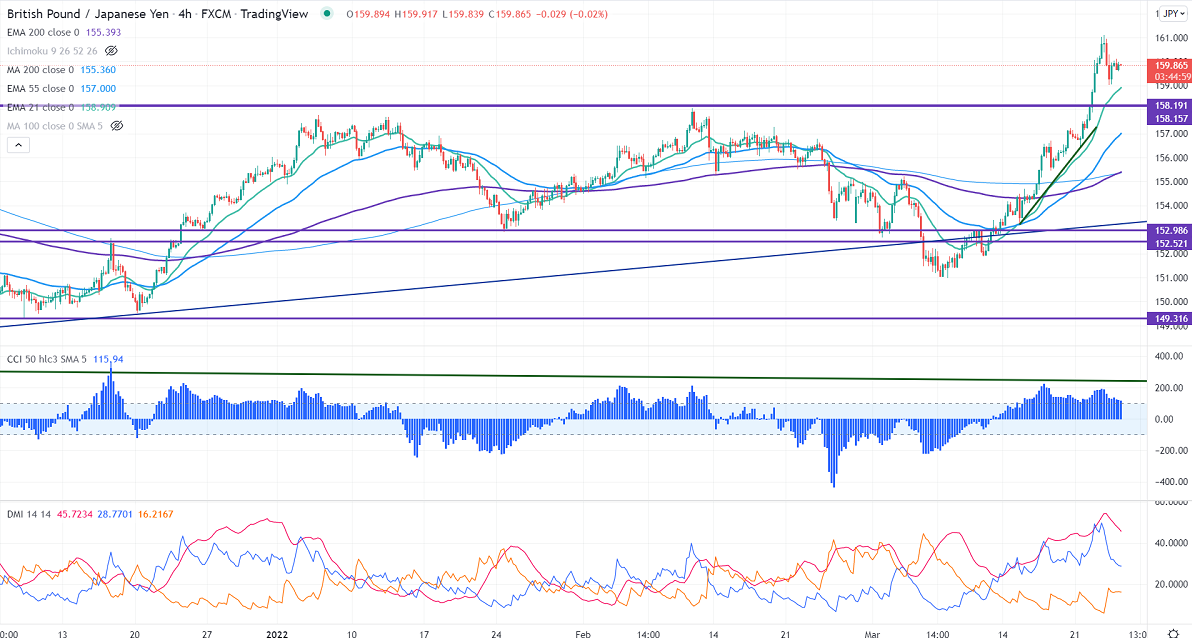

Short-term resistance - 161

Intraday Support- 159

GBPJPY witnessed a profit booking after hitting a multi-month high of 161.10. The pound sterling lost its shine after upbeat UK CPI data. It has increased the chance of further rate hikes by BOE. The pullback in pound sterling against the USD also supports the pair at lower levels. Any breach below 1.3170 confirms further bearishness. The intraday trend of GBPJPY is bearish as long as resistance 161 holds. GBPJPY hits an intraday high of 160.12 and is currently trading around 159.90.

USDJPY- Analysis

The pair holds above 121 level on policy divergence between US Fed and BOJ. A jump to 122.65 is possible.

CCI Analysis-

The CCI (50) is above zero level in the 4-hour chart. The directional movement index shows a bullish trend. It confirms the short-term trend is bullish.

Technical:

The immediate resistance is around 161, any break above targets 163.80/165. On the lower side, near-term support is at 158.70. Any indicative violation below targets 158/157.75.

It is good to sell on rallies around 160.35-40 with SL around 161.20 for a TP of 158.