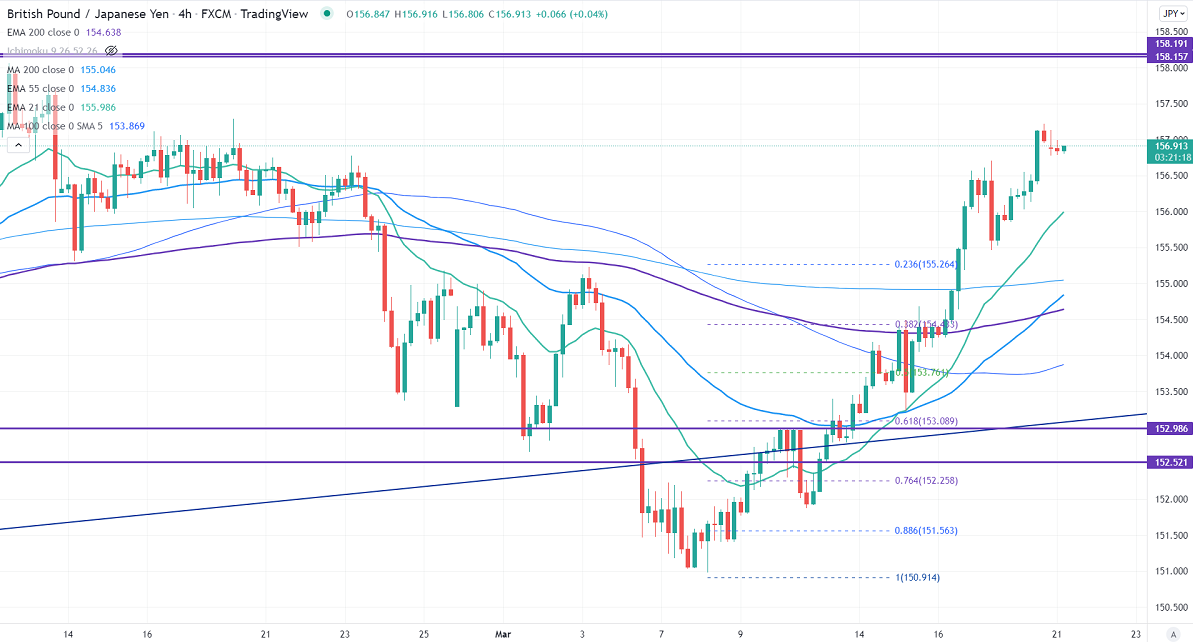

Short-term resistance -157.25

Intraday Support- 155

GBPJPY regained sharply on weak Yen. The pair surged sharply after BOE hiked rates by 25 bpbs for the third consecutive time. Markets eye UK CPI on Wednesday for further direction. The pound sterling dropped from a minor top 1.3210. Any close above 1.3200 confirms further bullishness. The intraday trend of GBPJPY is bullish as long as support 155 holds. GBPJPY hits an intraday high of 156.99 and is currently trading around 156.85.

USDJPY- Analysis

The pair recovered after BOJ has kept its rates unchanged. A jump to 120 is possible.

CCI Analysis-

The CCI (50) is above zero level in the 4-hour chart. The directional movement index shows a bullish trend. It confirms the short-term trend is bullish.

Technical:

The immediate resistance is around 157.25, any break above targets 157.75/158.20. Significant bullish continuation if it breaks 158.20. A jump to 160 is possible. On the lower side, near-term support is at 155. Any indicative violation below targets 154.20/153.50.

It is good to buy on dips around 156.50 with SL around 155.45 for a TP of 157.75/158.20.