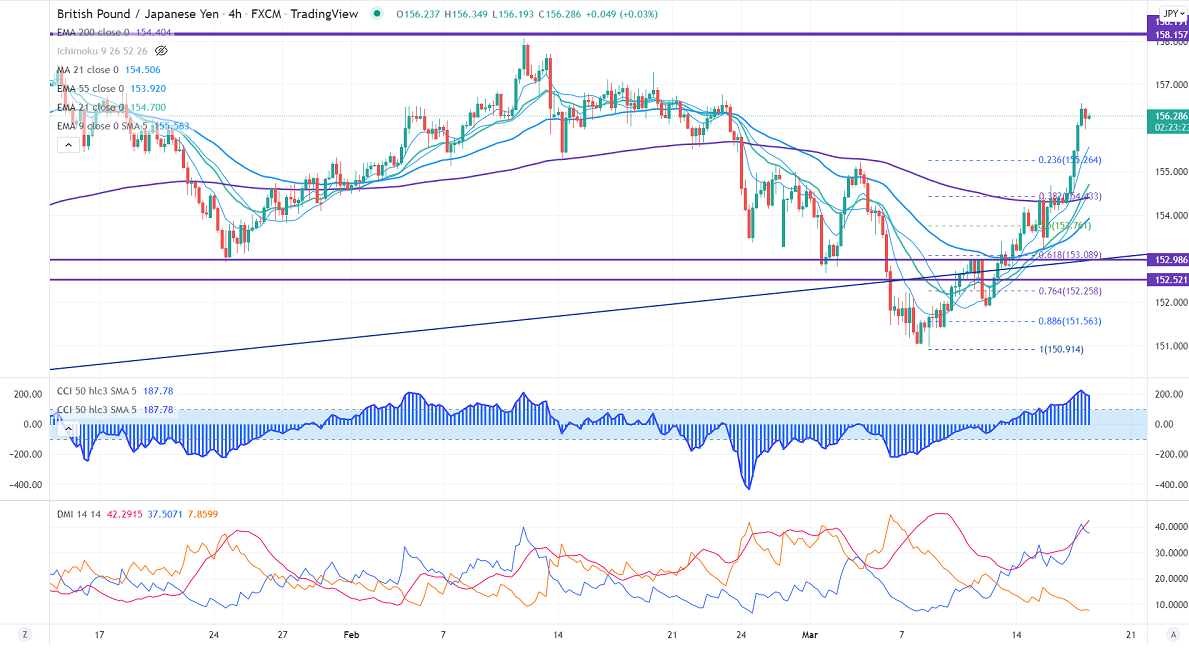

Short-term resistance -156.80

Intraday Support- 155

GBPJPY hits two weeks high on the strong Pound sterling. It regained sharply above 1.31500 after Fed hikes rate as expected. Any breach above 1.3200 confirms further bullishness. Markets await BOE monetary policy for further direction. The intraday trend of GBPJPY is bullish as long as support 155 holds. GBPJPY hits an intraday high of 156.57 and is currently trading around 156.23.

USDJPY- Analysis

The pair trades above 118 and hits the highest level since Jan 2017 on surging US Treasury yields. A jump to 118.65 is possible.

CCI Analysis-

The CCI (50) is above zero level in the 4-hour chart. The directional movement index shows a bullish trend. It confirms the short-term trend is bullish.

Technical:

The immediate resistance is around 154.90, any break above targets 155.30. Significant bullish continuation if it breaks 155.30. A jump to 156/157 is possible. On the lower side, near-term support is at 153.50. Any indicative violation below targets 152.75/152.

It is good to buy on dips around 155.80 with SL around 155 for a TP of 157.75/158.20.