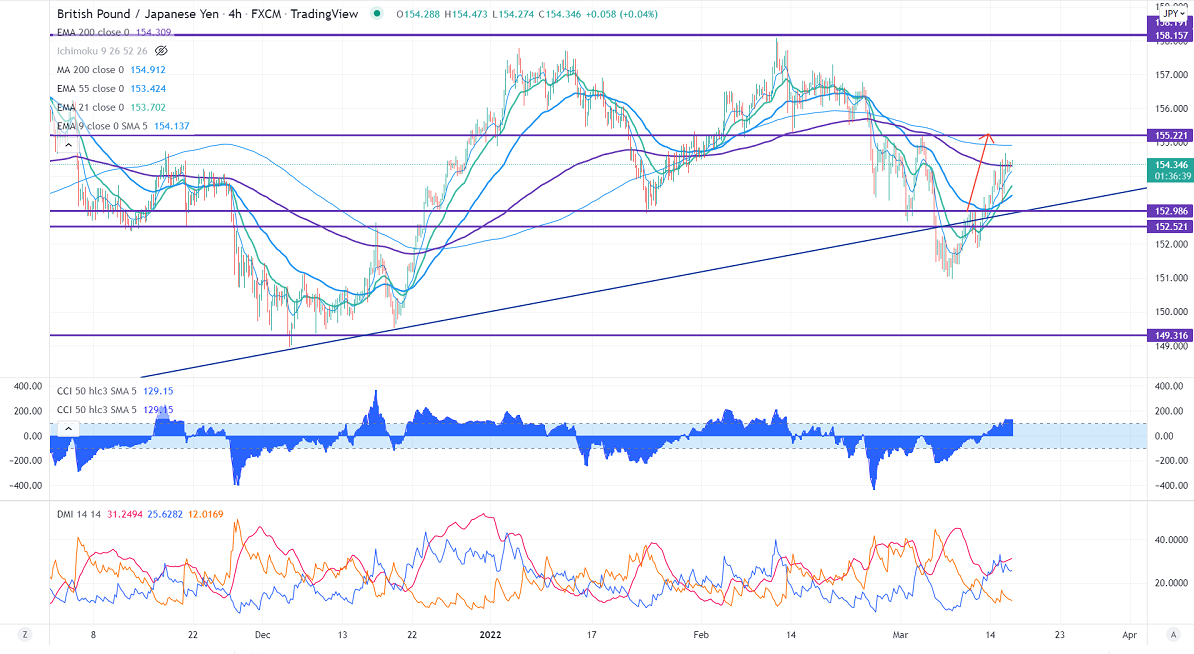

Short-term resistance -154.90

Intraday Support- 153.50

GBPJPY continues to trade higher for fourth consecutive days on weak Yen. The pound sterling recovered above 1.3050 on better than UK employment data. The unemployment rate declined to 3.9% in Jan vs 4%. Any breach above 1.3090 confirms further bullishness. The intraday trend of GBPJPY is bullish as long as support 153.50 holds. GBPJPY hits an intraday high of 154.472 and is currently trading around 154.457.

USDJPY- Analysis

The pair trades above 118 and hits the highest level since Jan 2017 on surging US Treasury yields. A jump to 118.65 is possible.

CCI Analysis-

The CCI (50) is above zero level in the 4-hour chart. The directional movement index shows a bullish trend. It confirms the short-term trend is bullish.

Technical:

The immediate resistance is around 154.90, any break above targets 155.30. Significant bullish continuation if it breaks 155.30. A jump to 156/157 is possible. On the lower side, near-term support is at 153.50. Any indicative violation below targets 152.75/152.

It is good to buy on dips around 154.20 -25 with SL around 153.50 for a TP of 155.30/156.