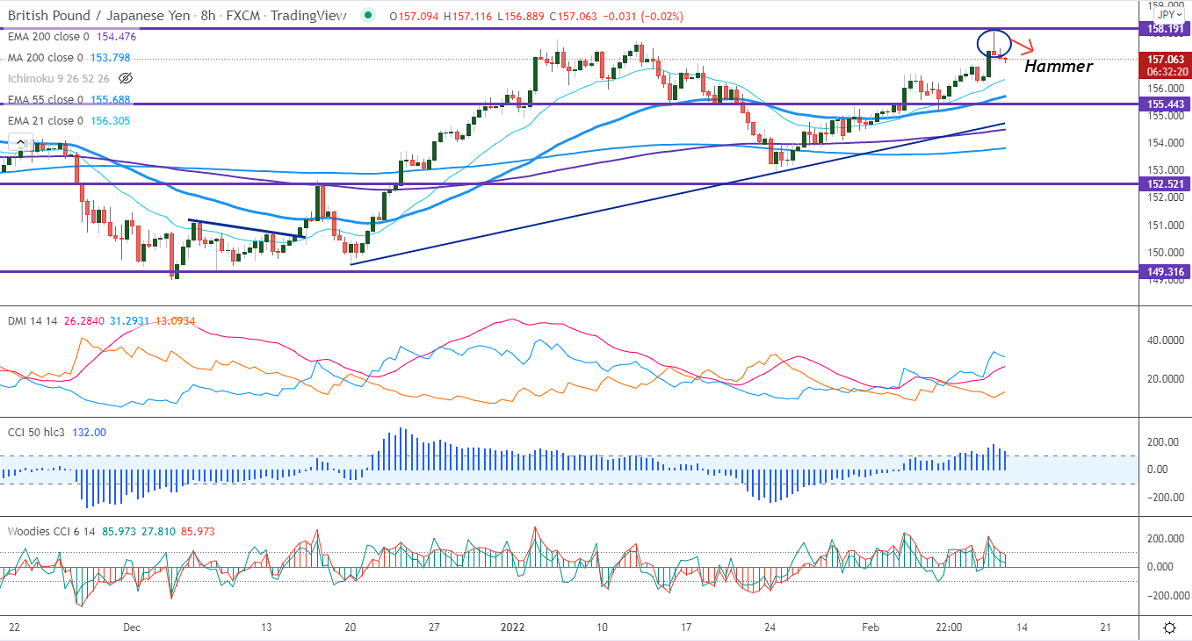

Short-term resistance -158.50

Intraday Support- 156

GBPJPY halted its three weeks of an uptrend and shown a decline of more than 100 pips on the weak Pound sterling. GBP is under pressure against the US dollar after an upbeat US CPI. The UK GDP shrank by 0.2% in Dec as omicron affects recovery. Any breach below 1.3490 confirms further bearishness. The intraday trend of GBPJPY is bearish as long as resistance 158.50 holds. GBPJPY hits a low of 156.88 and is currently trading around 157.05.

USDJPY- Analysis

The pair continues to trade higher ahead of US inflation data. The intraday bullishness if it breaks 115.70.

CCI Analysis-

The CCI (50) and Woodies CCI hold above zero levels in the 4 -hour chart. It confirms the bullish trend.

Technical:

The immediate resistance is around 156.70, any break above targets 157/157.75/158.50. Significant bullish continuation if it breaks 158.50. On the lower side, near-term support is at 155.50. Any indicative violation below targets 155/154/153/151.95/150.

Indicator (8-Hour chart)

Directional movement index –Bullish

It is good to sell on rallies around 157.30-35 with SL around 158.10 for a TP of 155.