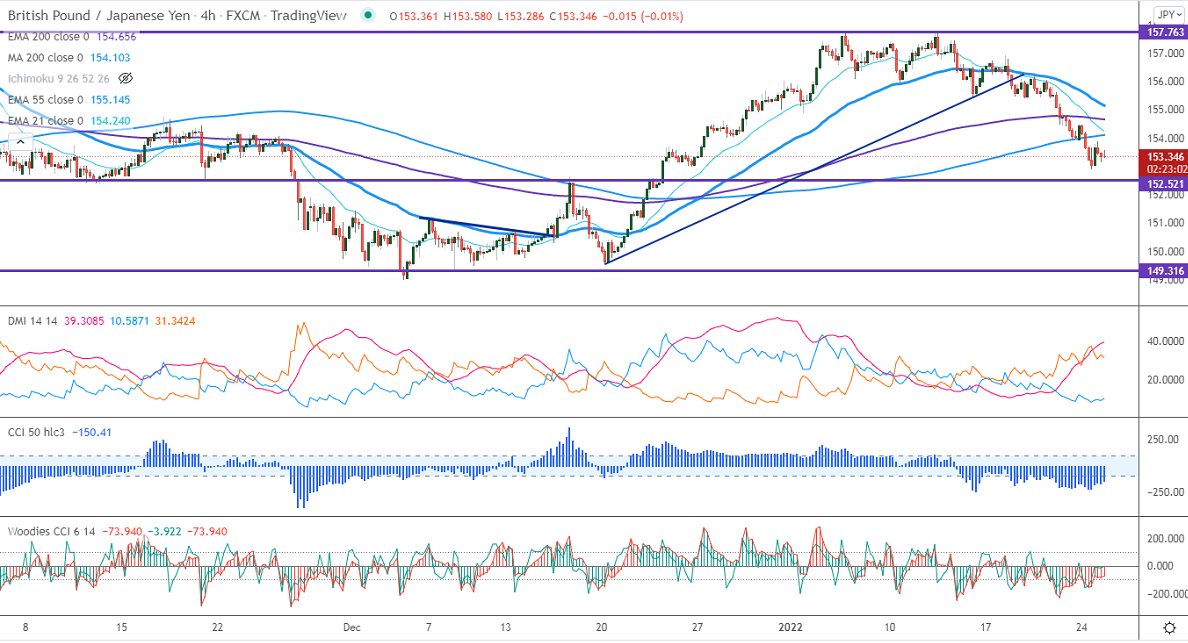

Short-term resistance -154.50

Intraday Support- 152.85

GBPJPY continues to trade lower for a third consecutive week on board–based pound sterling weakness. It has dropped to 1.34403 against USD, the lowest level in three weeks. Any breach below 1.3380 confirms further bearishness. The UK January flash services came at 53.30 vs an estimate of 54. The intraday trend of GBPJPY is bearish as long as resistance 155 holds. GBPJPY hits an intraday low of 153.12 and is currently trading around 153.35.

USDJPY- Analysis

The pair declined to 113.47 yesterday on safe-haven demand. The intraday bearishness only if it breaks 113.

CCI Analysis-

The CCI (50) and Woodies CCI hold below zero levels in the 4-hour chart. It confirms the bearish trend.

Technical:

The immediate resistance is around 154.20, any break above targets 154.70/155.25/156.10. Significant bullish continuation if it breaks 158.50. On the lower side, near-term support is at 152.85. Any indicative violation below targets 151.95/150.

Indicator (4-Hour chart)

Directional movement index –Neutral

It is good to sell on rallies around 153.55-60 with SL around 154.50 for a TP of 151.90.