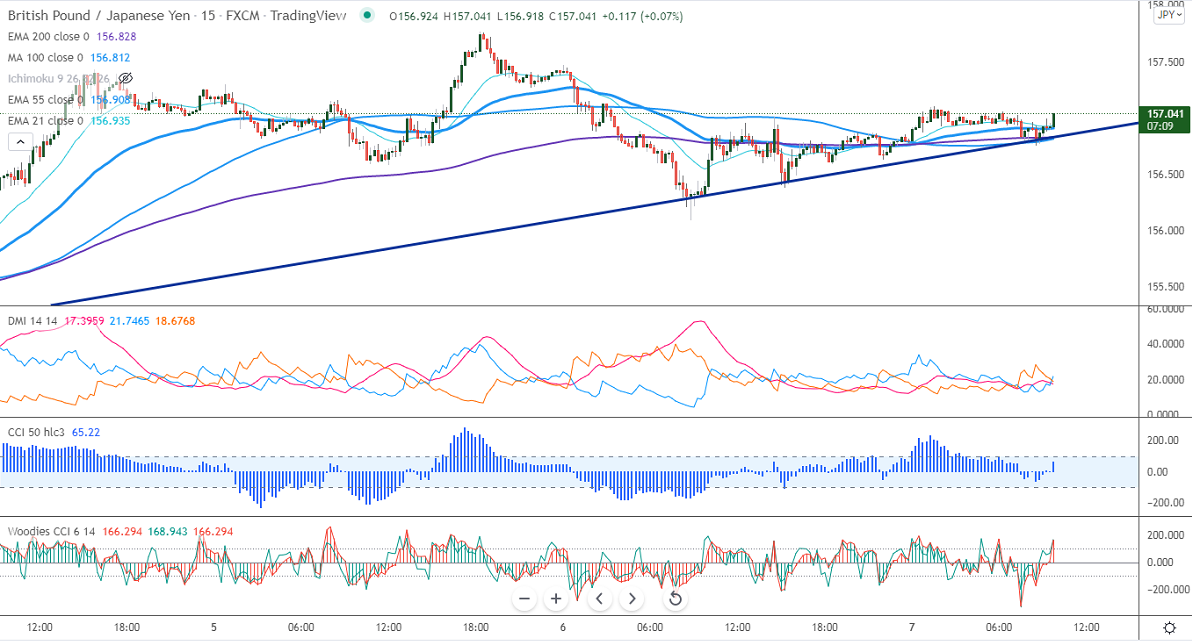

Short-term resistance -157.25

Intraday Support- 156

GBPJPY has shown a minor pullback after hitting a low of 156.08. The minor weakness in the pound sterling is putting pressure on the pair at higher levels. GBP recovered more than 30 pips against USD on upbeat market sentiment. Market eyes US NFP and Brexit for further direction. The UK has reported another 179756 daily cases slightly lower compared to the previous day-case 194975. Any breach above 1.3600 confirms further bullishness. The intraday trend of GBPJPY is bullish as long as support 154.80 holds. GBPJPY hits an intraday low of 156.75 and is currently trading around 156.80.

USDJPY- Analysis

The pair showed a profit booking despite surging US Treasury yields. The intraday bullishness only if it breaks 116.25.

CCI Analysis-

The CCI (50) and Woodies CCI hold above zero levels in the 15 min chart. It confirms an intraday bearish trend.

Technical:

The immediate resistance is around 157.25 any break above targets 158/158.50. Significant bullish continuation if it breaks 158.50. On the lower side, near-term support is at 156.50. Any indicative violation below targets 155.70/155.25/154.70/154.

Indicator (4-Hour chart)

Directional movement index –Neutral

It is good to sell on rallies around 156.85-90 with SL around 157.75 for a TP of 154.70.