Short-term resistance -151.50

Intraday Support- 150.60

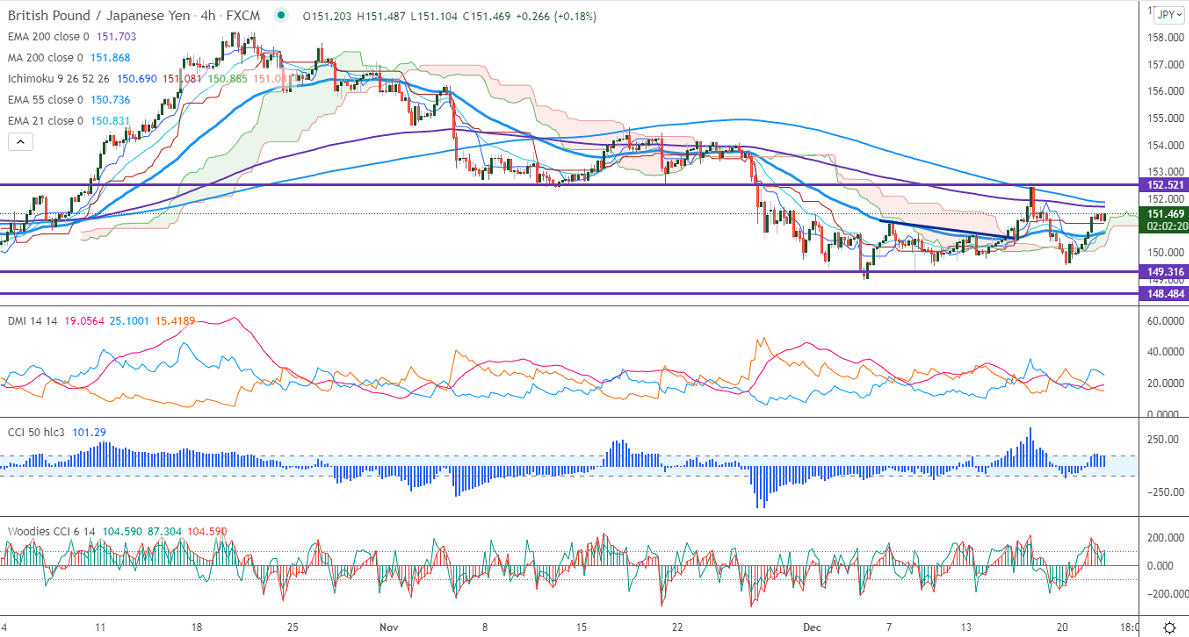

GBPJPY recovered strongly more than 150 pips on weak Yen. The pound sterling has halted its minor pullback on Brexit pessimism and Omicron concerns. The UK economy expanded by 1.1% QoQ compared to a forecast of 1.3% and yearly GDP came at 6.8% vs an estimated 6.6%. The number of new coronavirus cases surged more than 63% in the seven days to Dec 21st, 2021. Any breach above 1.3300 confirms intraday bullishness. The intraday trend of GBPJPY is bullish as long as support 150.60 holds. GBPJPY hits an intraday high of 151.455 and is currently trading around 151.30.

USDJPY- Analysis

The pair holds above 114 levels on higher yields. Any intraday bullishness only if it breaks 114.30.

CCI Analysis-

The CCI (50) and Woodies CCI hold above zero level in the 4- hour chart. It confirms an intraday bullish trend.

Technical:

The immediate resistance is around 150.40, any break above targets 150.75/151.25/152/152.60/153/153.52. Significant bullish continuation if it breaks 158.50. On the lower side, near-term support is around 149.50. Any indicative violation below targets 148.90/148.

Indicator (4-Hour chart)

Directional movement index –Bullish

It is good to buy on dips around 151 with SL around 150.50 for a TP of 152.50.