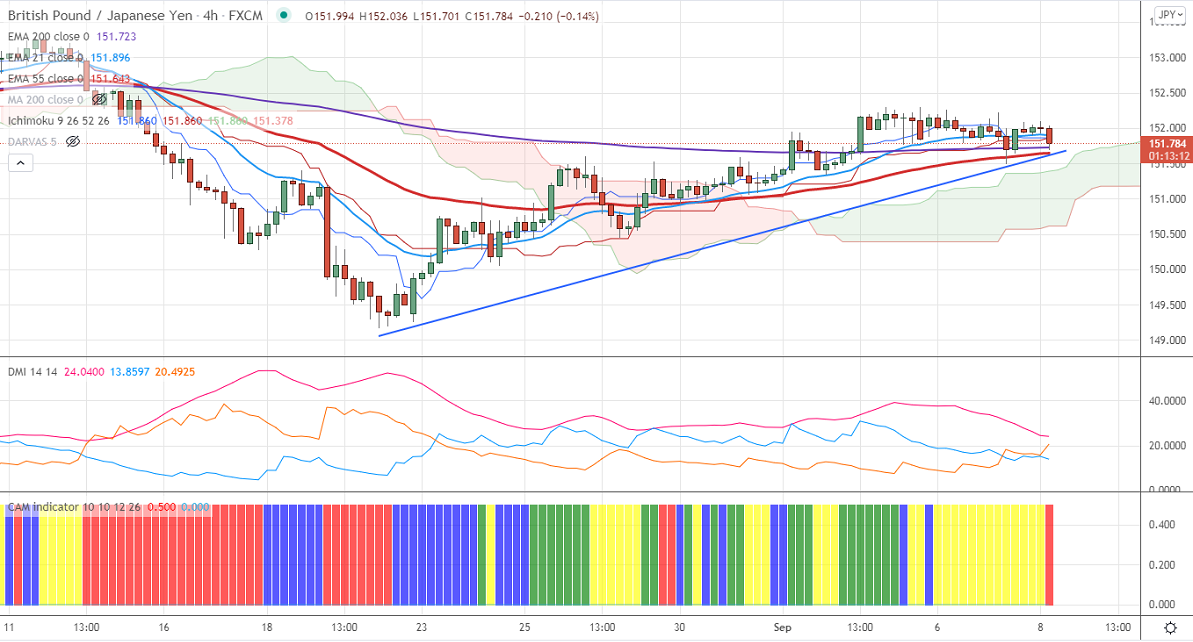

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 151.86

Kijun-Sen- 151.82

Major Intraday resistance -152.30

Intraday support- 151.75

GBPJPY is trading in a narrow range between 152.29 and 151.49 for the past four days. The minor weakness in pound sterling as UK PM Johnson plans to increase tax to pay for health and social care reform. GBPUS D is holding below 1.3800 levels, a dip till 1.37150 is possible. The intraday trend of GBPJPY is bullish as long as support 151 holds.

USDJPY- Analysis

The pair hits a fresh monthly high at 110.44 on surging US Treasury yields. Significant resistance is around 110.80.

Technical:

The pair's immediate resistance is around 152.29, any surge above targets 152.50/153/153.50. Significant bullish continuation if it breaks 153.50. On the lower side, near-term support is around 151.49. Any indicative violation below targets 151.30/151/150.45/149/148.45.

Ichimoku Analysis- The pair is trading below 4- hour Kijun-Sen and below Tenken-Sen

Indicator (Hourly chart)

CAM indicator- Slightly Bullish

Directional movement index –Bearish

It is good to buy on dips around 152 with SL around 151.30 for a TP of 153.50.